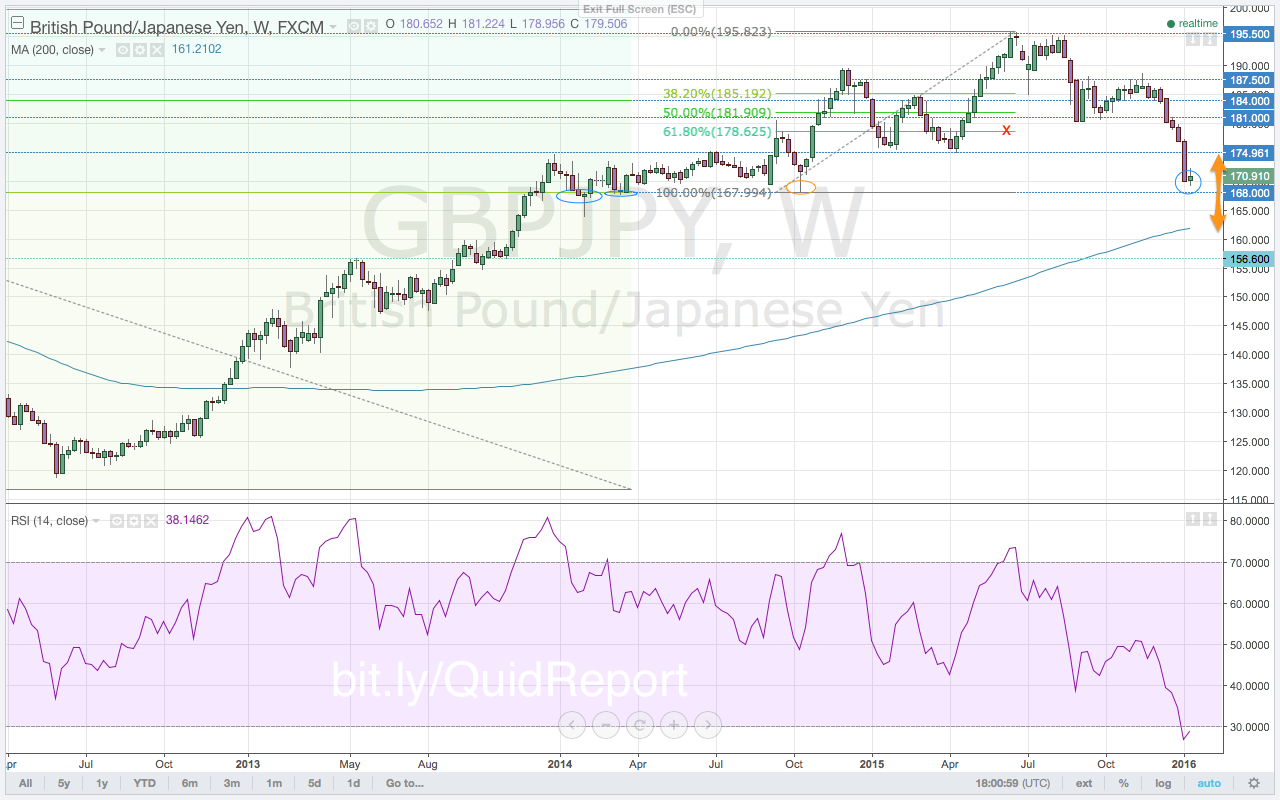

The Japanese yen has found new strength on the back of risk aversion flows. It is one of the biggest beneficiaries as a safe haven currency. With the Swiss National Bank intervening to prevent safe haven flows from strengthening the Swiss franc and the U.S. dollar dealing with new interest rate expectations, the JPY has received a bulk of the risk aversion flows in the market. Evidence of this is the huge gap down the $GBPJPY experienced when the new trading week opened compared to the $GBPUSD or GBP/CHF. As the Greek debt crisis now deals with this new normal — a rejected austerity plan and debt repayment package — the $GBPJPY may continue to move lower.

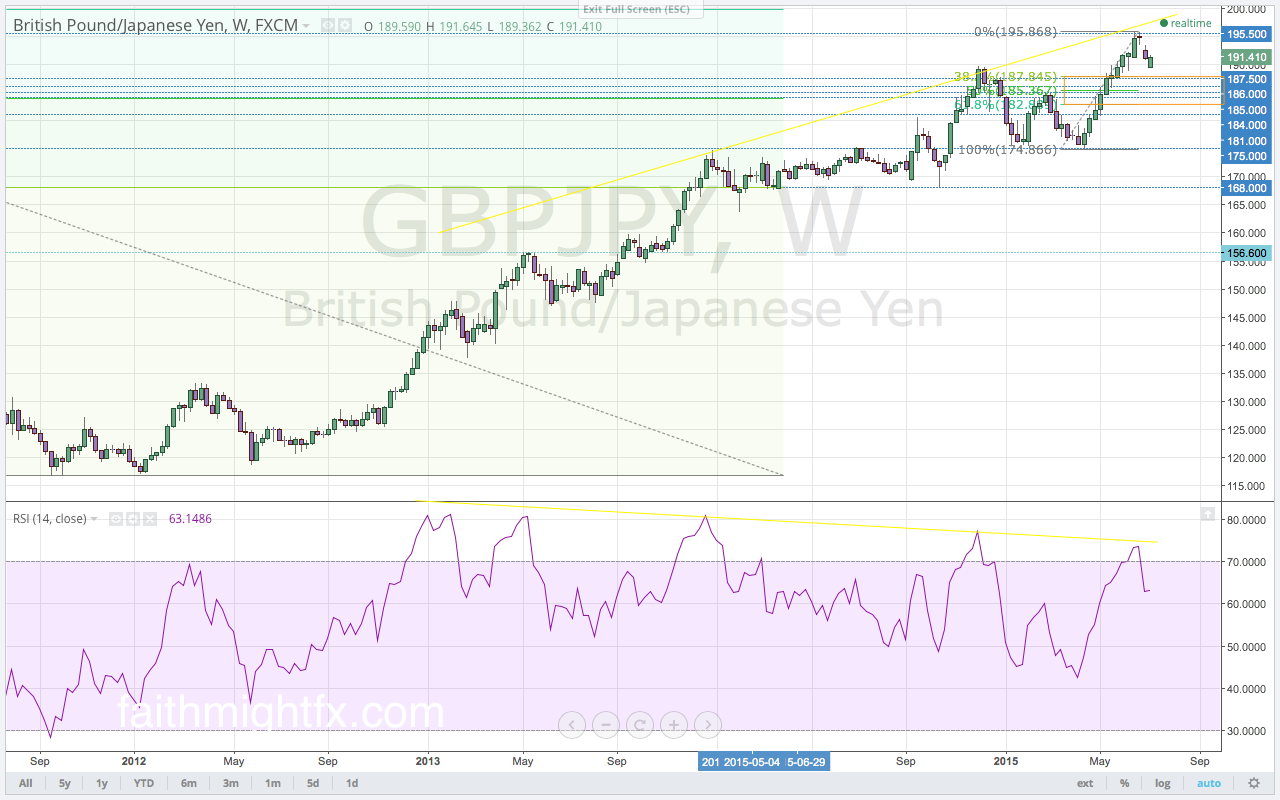

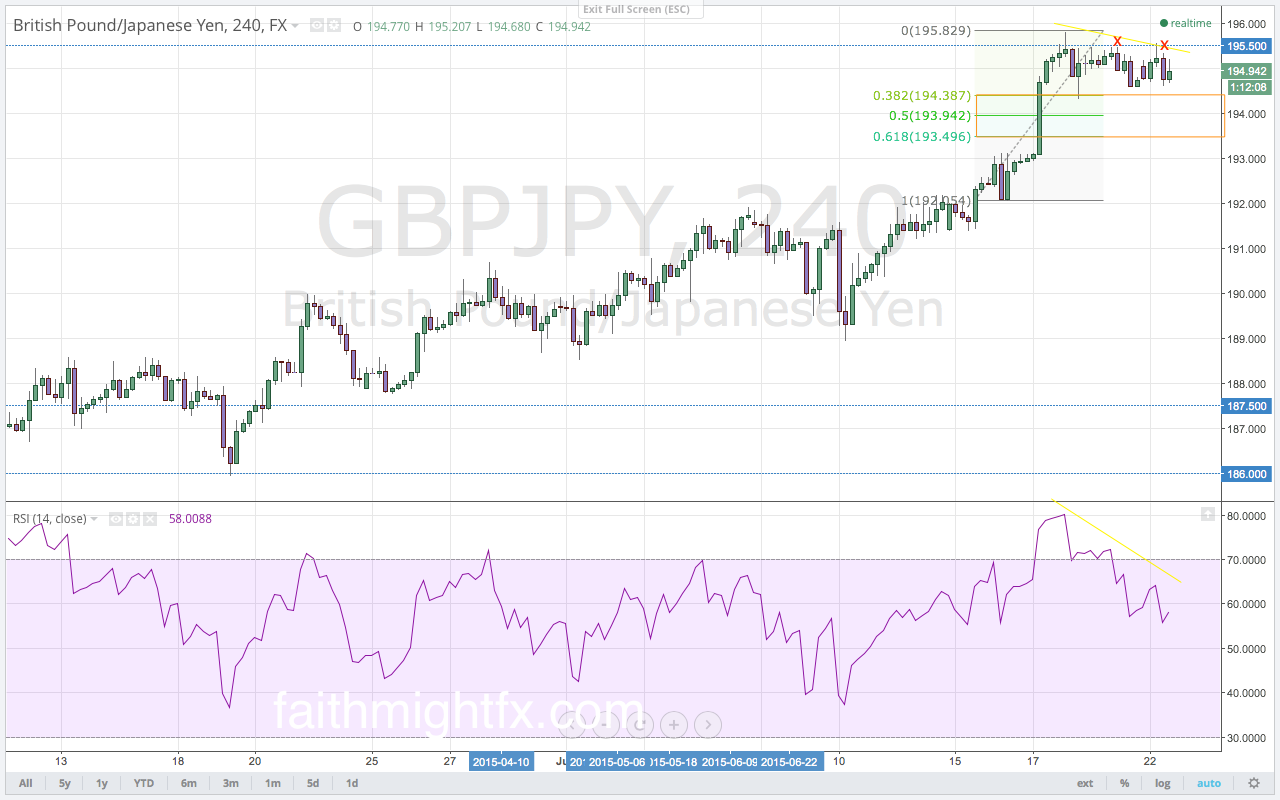

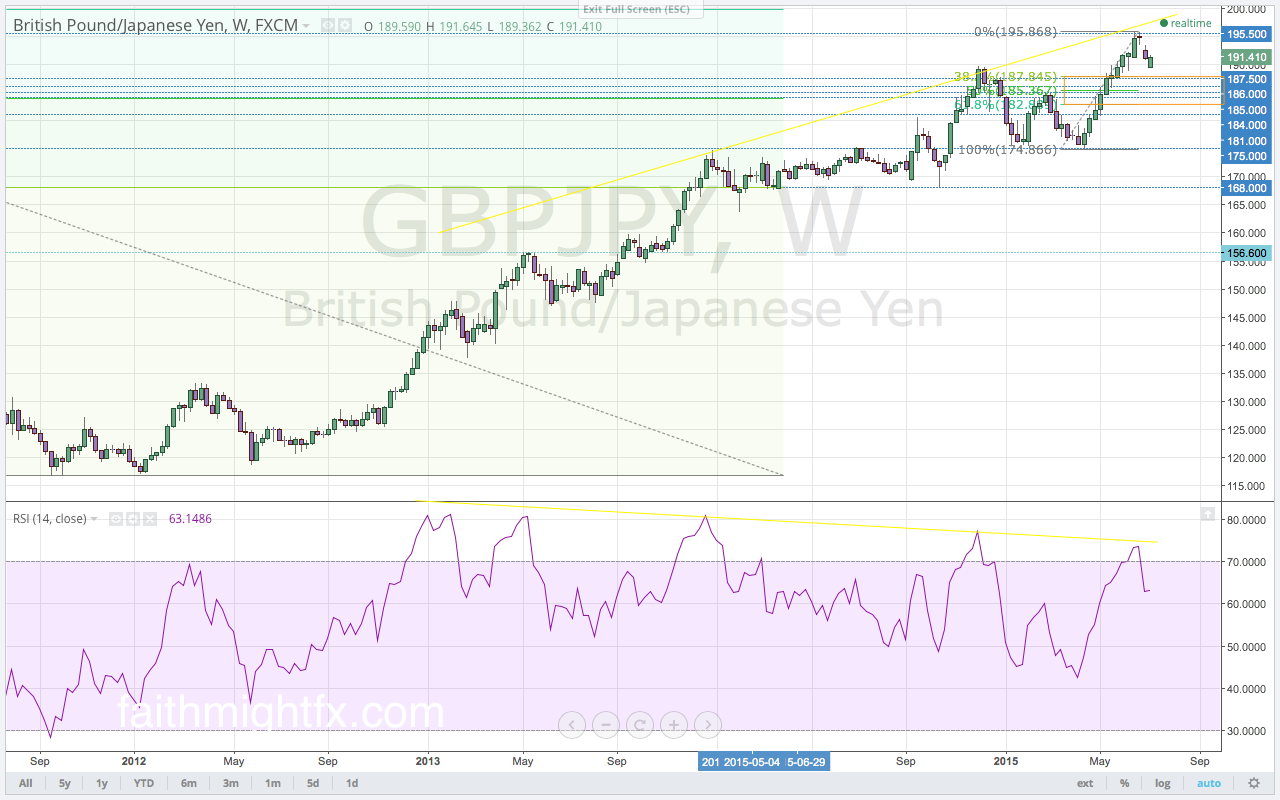

The $GBPJPY made a new low at 189.59 [on Monday], establishing a level of support for the week. A move below the gap low targets the 38.2% Fibonacci level at 187.84. The major support and psychological level at 1.9000 is the level to watch for direction in the new trading week. The prior bullish wave already found resistance just ahead of the 1.9000 level at 189.68. Last week’s bounce higher after the gap down still has yet to fill the gap even as the bounce higher this week has already filled the gap. A continued inability of the $GBPJPY to fill its own, very large gap is a bearish signal. Coupled with the building bearish divergence between price and momentum at the recent 195.86 new highs, the $GBPJPY is poised to move into a deeper correction of the entire rally off the 175.00 major support level.

Momentum on the daily chart waned very sharply at the highs last week. This sharp decline in buying momentum resulted in multiple false breaks of the 195.50 resistance level. Though the gap lower is due to fundamental reasons, its occurrence lines up with the technical developments over the last several trading sessions. Already lower than the previous low on the RSI, this new selling momentum has broken below the 50.0 level into bearish territory. The gap lower this week has broken below the major 190.00 support level. However, that price move lower was immediately met with bids that rallied price right back above the 190.00 level to a high of 191.64. These highs are finding resistance ahead of last week’s lows. If the $GBPJPY is unable to move higher, it is likely that price will fall back towards the 190.00 support level.

This is an excerpt from this week’s issue of Quid Report. Subscribers receive my research on all major GBP pairs at the beginning of the week, including access to @faithmightfx on Twitter for daily, real-time updates to the weekly report. AVAILABLE NOW.