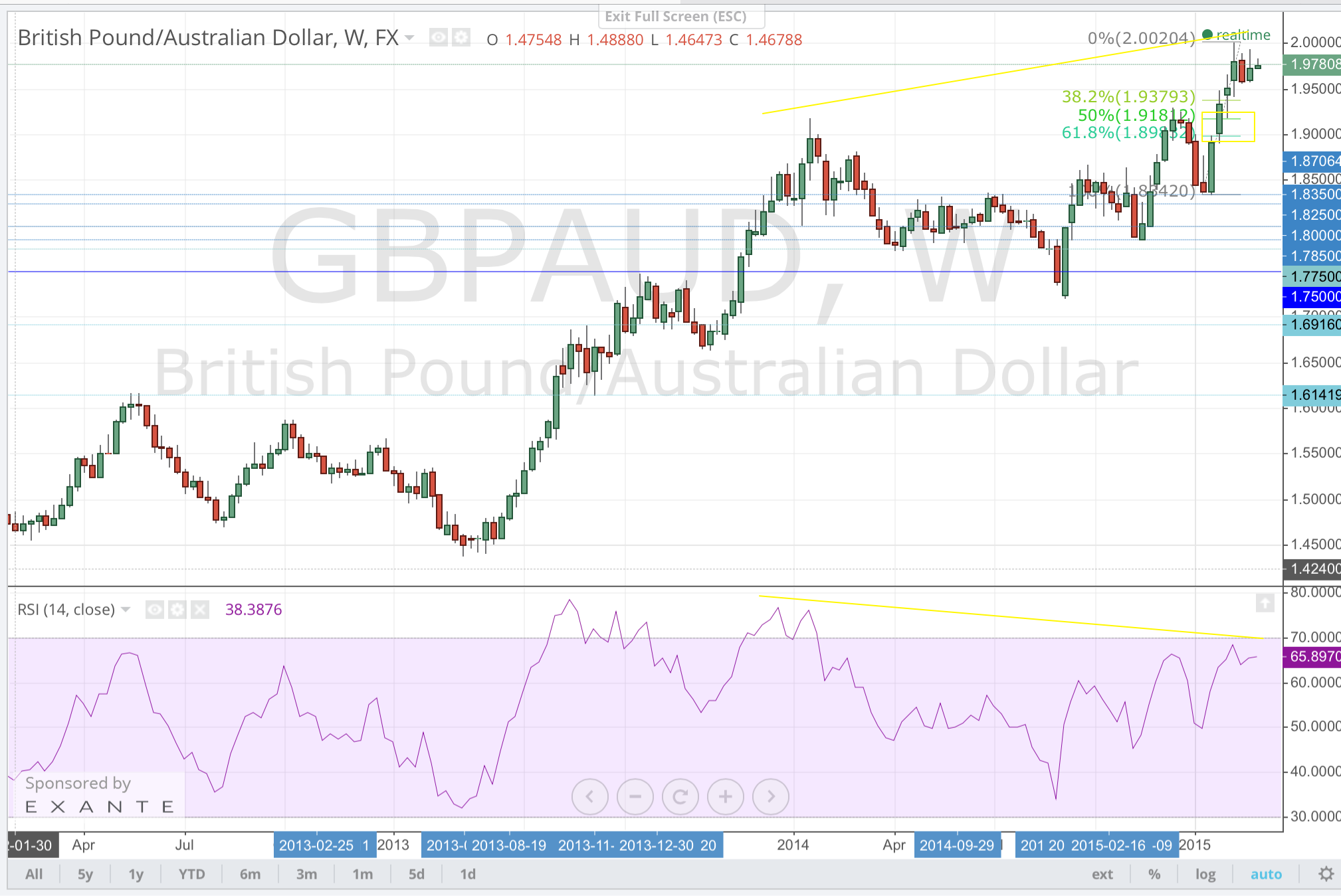

The GBPAUD has been in consolidation mode since making new multi-year highs at the 2.00 level, a major psychological level. The consolidation has the GBPAUD range bound as the trading week opens. Over the weekend the People’s Bank of China (PBoC) cut interest rates for the second time this year by 25 basis points. When bearish news breaks in China, it is oftentimes reflected in a weak AUD. However that trend was bucked as the Reserve Bank of Australia delivered its decision on monetary policy this Tuesday. Markets did not respond to the PBoC with the RBA announcement so imminent.

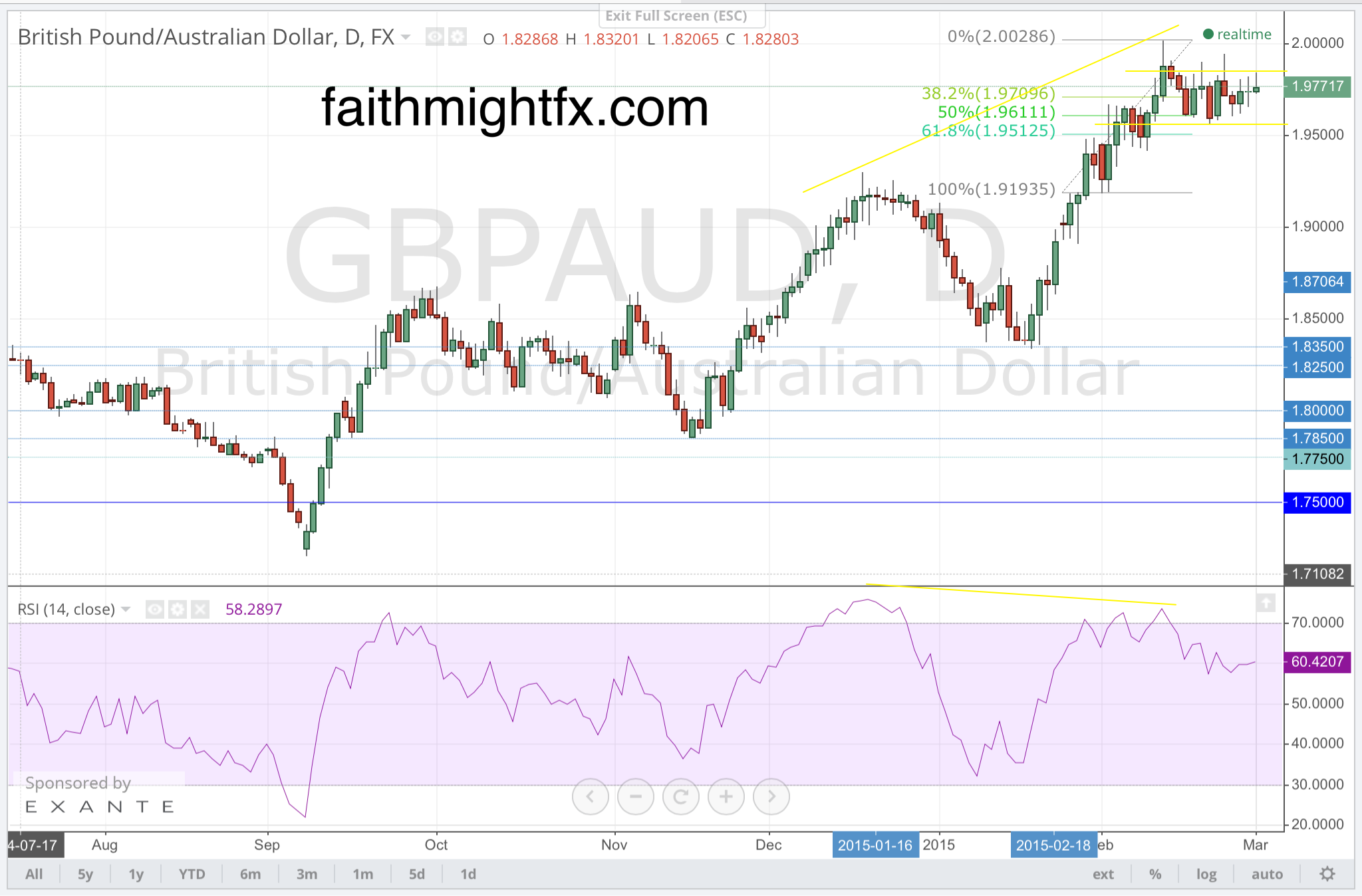

The bearish divergence on the daily chart is slight. While it is not terribly indicative of a sell-off, there has been a decline to new lows. The RBA maintains its dovish rhetoric even as they didn’t move on monetary policy this month after cutting interest rates just a month ago. This RSI divergence could help prices slide back to the bottom the range around 1.9600. A break lower looks for 1.9500, however, it would take a shift in sentiment out of the RBA for prices to break below the 1.9500 support level and 61.8% Fibonacci level.

The bearish divergence on the weekly chart is even more pronounced than on the daily chart. These bearish divergences signal a deeper sell-off is more likely before the rally resumes. If the RBA had delivered more hawkish rhetoric or the Bank of England indicates a delay in interest rate hikes on Thursday, a deeper correction takes price back to the major whole number at 1.90. This 1.9000 level also coincides with the big 61.8% Fibonacci level on the weekly chart.

Trade what you see.