The USD has been relentless in its rally this year, particularly against the EUR, GBP, AUD, and NZD. WHY?

- In case you missed it, the United States has the highest interest rates in the G7. Remember when, the top spot was held by Australia and New Zealand?

- The Federal Reserve has not delivered an interest rate cut in over 10 years.

- The United States is in its longest economic expansion on record. While we seem to witness blips of weakness in the data this year, economic releases from durable goods order to consumer confidence to inflation and GDP all point to a still robust American economy.

Yeah, I don’t see any reason to sell the dollar either.

When the Federal Reserve finally delivers on all of the dovish rhetoric it has graced us all with since early 2018, the market will most certainly react by selling USD. The larger the cut, the larger the selloff because the market will be shocked at anything larger than a 50 basis points cut. But USD weakness won’t last without a strong statement from the Fed that signals more cuts to come. I’m not so sure that the fundamentals supports a cycle of rate cuts. Even this anticipated rate cut is debatable. Plus, the Fed has been unsuccessful at talking down the USD for over 2 years now. I doubt tomorrow’s meeting changes the market’s mind very much.

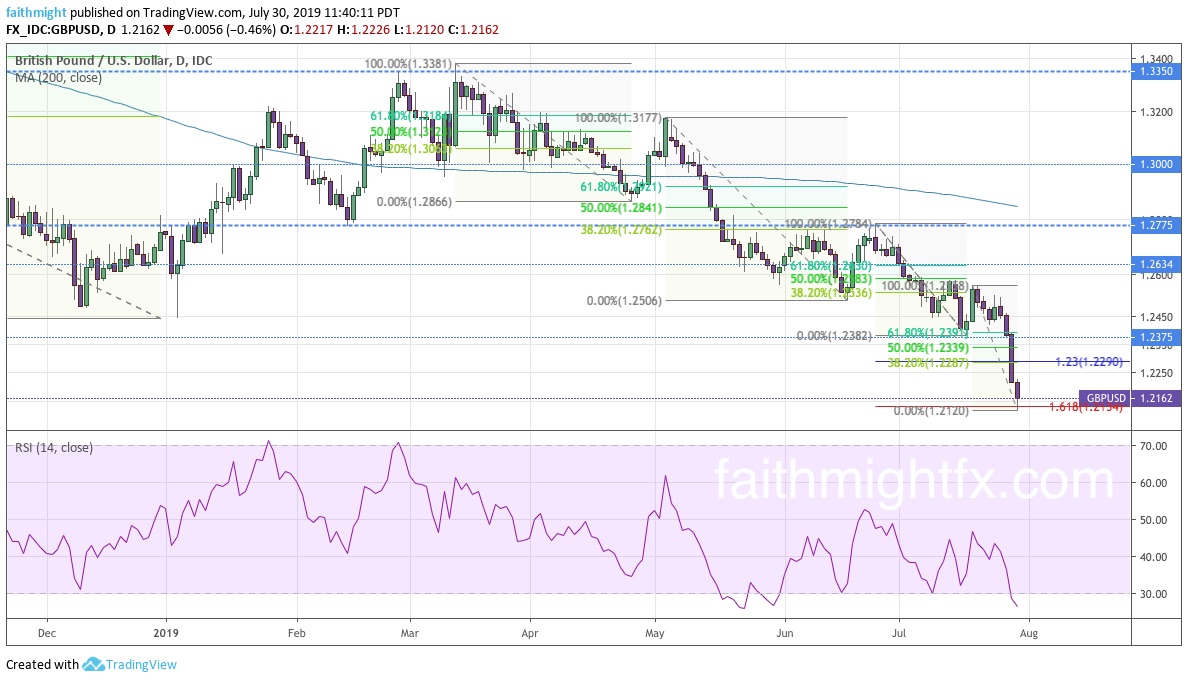

The $GBPUSD has had a great run this year and is now starting to probe the post-Brexit levels in 2016/17. Monday’s dumping of the $GBPUSD hit some major Fibonacci extension levels on the latest leg down. Now markets gear up for tomorrow’s announcement.

Trade what you see, not what I think.

Related reads:

- Graph of U.S. interest rates (Forex Factory)

- Greenspan says it’s sensible for the Fed to think about ‘insurance’ cut (MarketWatch)

- Strong consumer spending vs. weak business investment: What really matters for the US economy (CNBC)