The popular social media app TikTok has taken millennials and Gen Zers by storm during the pandemic. It has become the video-sharing app of celebrities and influencers and has become a past time similar to scrolling through Instagram and Snapchat. TikTok has also, in recent months, become leverage of political warfare.

ByteDance (TikTok’s parent company) first began causing controversy in India. India banned TikTok for two weeks after border disputes between China had caused an insurrection between the two nations. As a result of this combined with the ongoing tariff war between the U.S. and China, President Trump announced earlier this week about dismantling TikTok due to potential data breaching. China, for years, has been known to tamper with U.S intellectual property. Now with its recently passed security laws, this could be something to carefully look at.

From an investment standpoint, ByteDance has no plans of releasing an IPO and is thought to be overvalued. This is because the app’s popularity recently gained serious attention and still has problems with much-needed consumer retention, especially outside of mainland China. Despite these shortcomings, there are still signs of potential growth with its recent attention through the media. This has especially been made apparent with Microsoft drawing interest to acquire the app. Microsoft wants TikTok because of its data potential. It was announced that Microsoft is heading into a deal with ByteDance for TikTok. It is simply now waiting for final approval from the U.S. government.

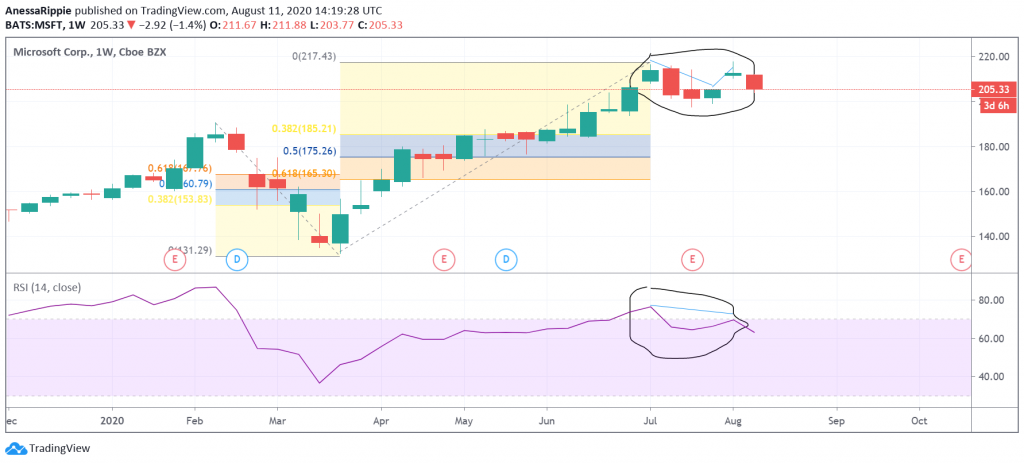

After crashing to lows along with the broader market in mid-March, $MSFT bounced back and increased users among its Microsoft Teams video app and with its Xbox. This could also be attributed to its steady but consistent RSI at 60. Which expresses no giant volatile troths but does show uptake of more buyers coming in while still showing slight contractions which therefore confirm our Fib sequences. The recovery in price is supported by consistent RSI. Although, the contraction in price is being confirmed by the bearish divergence between price and momentum (RSI). Overall, $MSFT is clearly in an upward trend with the potential to continue to drive higher in the long-term. In the short-term, according to our highlighted Fib sequences and the bearish divergence between price and momentum, there looks to be some slight contraction before it starts to really prove its gains.