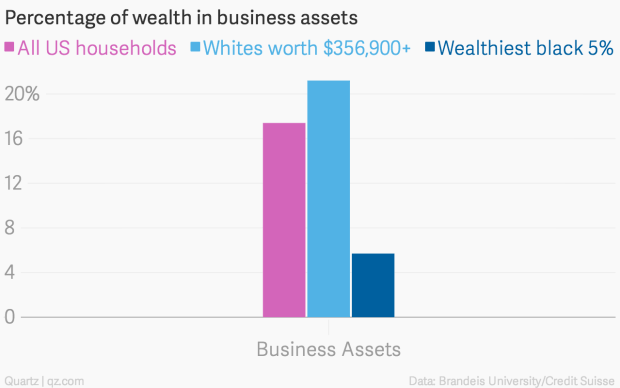

This August, the SEC finally came around to update its definition of an accredited investor. The old definition, while meant to protect small, individual investors, also locked many more folks out of venture capital and other alternative asset classes. These asset classes are also the most lucrative investments an investor can make. So when we talk about the wage gap, in any society quite frankly, the key differentiator is the ownership of business assets.

So I have been a huge advocate of individuals adding venture capital to their portfolio. Now I’m not advocating for blind investing. Never that. Even in the stock market, an investor should know why and what investment they are making with their money. But if you are, for example, a single individual with a net worth over $500,000, you can afford to consider even a single-digit allocation of your portfolio towards high risk, high reward alternatives.

No, the updated definition hardly opens up the floodgates for any ordinary investor. But it does allow more participation in the venture capital space, especially for people of color and young adults. And I believe that is a great thing for narrowing the wage gap. This policy change is a step in the right direction.

The new rule goes into effect this month. Find out if it makes sense for you and get invested!