I returned to the Live Analysis Room yesterday with some audacious calls for $GBPUSD, $GBPCAD, $GBPAUD, $GBPNZD and $GBPJPY. I couldn’t have timed it any better for today’s volatile trading day seemed to deliver on all those calls.

Author: @faithmight

-

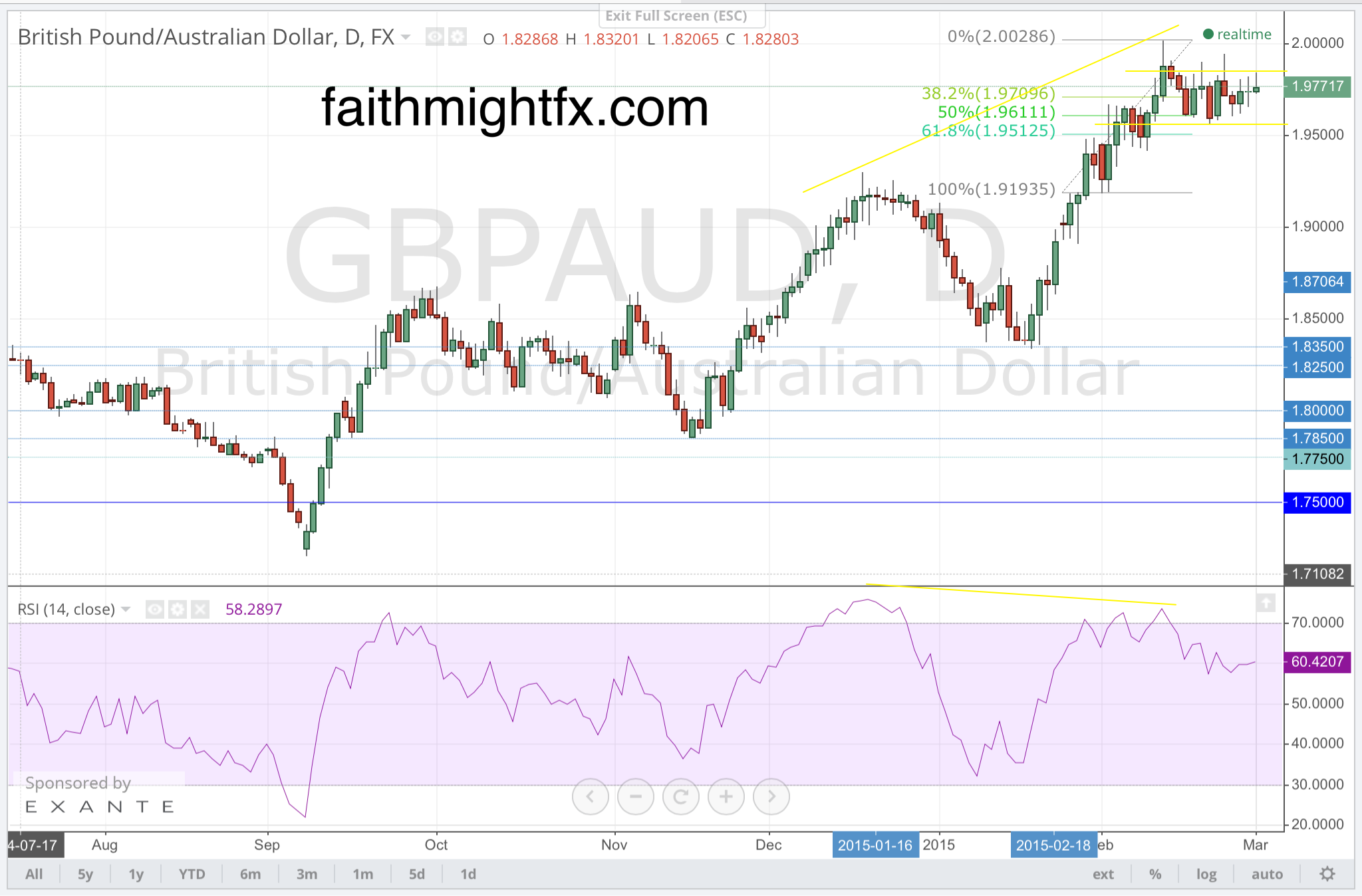

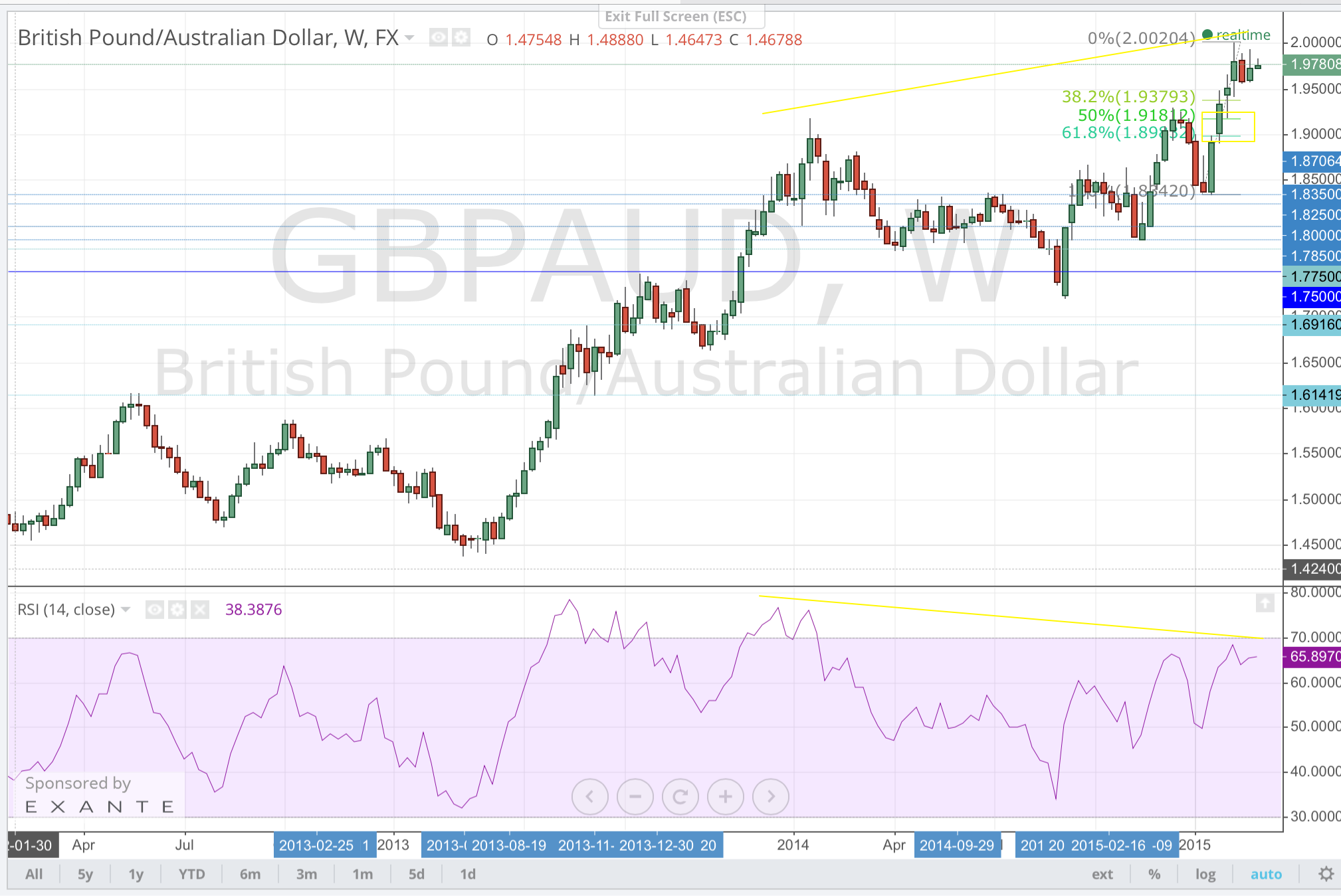

Aussie Finally Breaks Consolidation

The GBPAUD has been in consolidation mode since making new multi-year highs at the 2.00 level, a major psychological level. The consolidation has the GBPAUD range bound as the trading week opens. Over the weekend the People’s Bank of China (PBoC) cut interest rates for the second time this year by 25 basis points. When bearish news breaks in China, it is oftentimes reflected in a weak AUD. However that trend was bucked as the Reserve Bank of Australia delivered its decision on monetary policy this Tuesday. Markets did not respond to the PBoC with the RBA announcement so imminent.

The bearish divergence on the daily chart is slight. While it is not terribly indicative of a sell-off, there has been a decline to new lows. The RBA maintains its dovish rhetoric even as they didn’t move on monetary policy this month after cutting interest rates just a month ago. This RSI divergence could help prices slide back to the bottom the range around 1.9600. A break lower looks for 1.9500, however, it would take a shift in sentiment out of the RBA for prices to break below the 1.9500 support level and 61.8% Fibonacci level.

The bearish divergence on the weekly chart is even more pronounced than on the daily chart. These bearish divergences signal a deeper sell-off is more likely before the rally resumes. If the RBA had delivered more hawkish rhetoric or the Bank of England indicates a delay in interest rate hikes on Thursday, a deeper correction takes price back to the major whole number at 1.90. This 1.9000 level also coincides with the big 61.8% Fibonacci level on the weekly chart.

Trade what you see.

-

The Sterling Digest, 28 February 2015: en fuego

This #Merkel vs #Tsipras float strides across streets of Cologne during today’s carnival. #Greece crisis everywhere. pic.twitter.com/G1uYSuLai3

— Maxime Sbaihi (@MxSba) February 16, 2015

Sterling has staged big rallies across the board. Much of this new strength comes on the back of heightened expectations that the Bank of England (BoE) will increase interest rates even sooner than previously expected. As the market fully digests this new timeline in interest rate hikes, sterling has caught bid as traders buy in anticipation of tighter monetary policy.

While a big reason for the rally in sterling, monetary policy is not the only reason. Global deflation, due to the crash in oil prices, has caused other currencies to weaken considerably. As such, sterling has been able to rally to multi-year highs versus currencies like the Canadian dollar, the euro and the Australian dollar. Lastly, the sterling is catching bid as a safe haven currency. The discord between the the new Greek government and the rest of the European Union and continued manipulation by the Swiss National Bank in the francs markets, has traders piling into sterling as the only desirable European currency available. As long as these conditions continue to persist, expect sterling to continue to benefit on the long side in the medium term.

- Unemployment Down, Wages Up in U.K. (Bloomberg)

- U.K. Inflation Slows More Than Forecast to Record-Low: Economy (Bloomberg)

- Great Graphic: US and UK Unemployment (Traders Log)

- UK jobs reports, strong earnings fire up sterling (City Index)

- Does It Count as ‘Real’ Deflation When Prices Hit an Oil Slick? (Wall Street Journal)

- Bank of England increasingly divided on path for interest rates (Telegraph)

- ECB braces for QE as others shift rates (Yahoo! Finance)

-

The Sterling Digest, 14 February 2015: sentiment shifts

The U.S. jobs report was phenomenal. All kind of good points including a rise in the participation rate and an uptick in wage earnings. Finally! But 1 data point doesn’t make a trend. A data point that did trend this week, however, is U.S. retail sales. Retail sales in the world’s largest consumer economy missed for the second month in a row. And it missed big.

US December and January retail sales combined -1.7%

— Michael Hewson (@mhewson_CMC) February 12, 2015

This has sent the USD to consolidate lower across the board. Even oil has managed to stage an impressive rally to close the week. Oil continues to be a major headline in the markets. It was mentioned throughout the Bank of England’s Quarterly Inflation Report. With low inflation in the UK, due to oil prices, coupled with wage growth, the BoE believes inflation to rise faster than expected. Thus, rate hike expectations have actually accelerated resulting in a renewed rally in the GBP that could drive direction in sterling pairs in the mid-term.

- Mark Carney: Interest rates could hit new low (The Scotsman)

- The Tragedy of Modern Banking (Kass’ Korner)

- $2 Billion Vanished in Nigeria This Week and Most People Didn’t Notice (Venture Africa)

- Retail Sales Mystery: Where Are Americans’ Gas Savings Going? (WSJ)

- End of month thoughts: Dollar pushed (Piptrain.com)

-

The Sterling Digest, 31 January 2015: central bank drama

The World Economic Forum. The time of year when central bankers like to surprise. It’s been an incredible month. Our first trading month of 2015 is in the books and it did not lack for surprises and drama. Crashing oil prices kicked off volatile trading as the new year began. The Swiss National Bank got things going with their surprise abandonment of their currency peg to the euro and interest rate cut into negative territory. The Bank of Canada surprised markets too with its interest rate cut much sooner than markets expected. The European Central Bank also managed to surprise with a larger than expected quantitative easing package. The Federal Reserve surprised markets too but in the other direction. While it did not make any changes to monetary policy, the $FED remains hawkish following Yellen’s hawkish signals in December. Finally, the Bank of England turned seemingly dovish with its hawks relinquishing their call for interest rate hikes. The incredible drama series that was January certainly sets the stage for a new normal to emerge in 2015.

- The Swiss currency bombshell – cause and effect (Financial Times)

- 2015: The global economy’s ‘sink or swim’ moment (CNN Money)

- Carney-Yellen Neck-and-Neck on Being First to Raise Rates (Bloomberg)

- Fed Waits, RBNZ Shifts (AshrafLaidi.com)

- The Forlorn British Pound: The ‘Schedule’ For Rate Hikes Pushes Out To 2016 (Seeking Alpha)

- Don’t Lose the Forest for the Trees: Dollar Rally Still in Early Days (Traders Log)

-

How Will The Fed Respond?

The $GBPUSD finally broke below psychological support at 1.5000 on the back of QE-induced euro selling. There is a bullish RSI divergence, however, at the lows. This is fueling the rally back to 1.5100 as the new trading week gets underway. However, it is likely to find resistance at the 50% Fibonacci level at 1.5109.

Traders, this week, have their eyes set to the Federal Reserve interest rate decision on Wednesday. It is likely that the $FED does nothing but it will be interesting to hear how Yellen performs during the press conference. Last month, she surprised the markets with her hawkish sentiment and the USD rallied as a result. A USD rally on a hawkish Yellen will manage to push the $GBPUSD to the lows at 1.4950.

However, it is a very different world now. The Swiss National Bank (SNB) has abandoned their currency peg in the $EURCHF, the Bank of Canada has cut interest rates, the Danish National Bank cut interest rates twice in a 1 week, the Central Bank of Nigeria has restricted USD buying versus the naira and the European Central Bank (ECB) has started in on a €1.1 trillion quantitative easing program. These unprecedented and surprise moves by the world’s central banks have likely been in response to the SNB or the ECB or both. So how will the $FED respond? The US central bank is not likely to enact monetary policy based on what others are doing or not doing. With Yellen hawkish but the rest of the FOMC fairly dovish along with the rest of the world, Wednesday will be a very interesting trading day and will likely dictate direction in the USD for the following trading sessions.

Given the chart, any rally in the $GBPUSD on a weakening USD seems well contained by the Fibonacci levels and the former support-turned-resistance zone. Trade what you see.

-

Confessions of a Forex Trader – I HATE Changing Brokers

After yesterday’s SNB surprise monetary policy decision, major forex brokers around the world are having serious solvency issues. Unfortunately, bad trades coupled with 100:1 leverage became a recipe for disaster as client accounts went negative and now owe money that they probably can’t pay back. The largest and most well-known broker in the United States, $FXCM, is amongst this crowd and good for them. I have absolutely no love for $FXCM. While I don’t make broker recommendation, I discourage any trader who asks me about $FXCM from opening an account with them. I have firsthand experience and I know they are a piss poor operation.

But the hardest thing for a forex trader, besides trading strategy and consistent execution, is finding a good broker. A good broker is crucial for the success of all traders. I have had to do it 4 times in my 8 years trading forex. Knowing how hard it is, I decided to document my process the last time I switched brokers to help other traders find one that met their trading style criteria. In light of the eventual closing of some brokers due to the SNB surprise, I am reposting the article here in hopes of guiding traders to the decent forex brokers out there.

But the hardest thing for a forex trader, besides trading strategy and consistent execution, is finding a good broker. A good broker is crucial for the success of all traders. I have had to do it 4 times in my 8 years trading forex. Knowing how hard it is, I decided to document my process the last time I switched brokers to help other traders find one that met their trading style criteria. In light of the eventual closing of some brokers due to the SNB surprise, I am reposting the article here in hopes of guiding traders to the decent forex brokers out there.Again, I don’t make broker recommendations. Follow the process and do the work. You’ll be better for it. Please, also keep in mind that my decisions about a particular broker SHOULD NOT be your own. That’s not the point. You need to have a clear idea of what YOU need from a broker in order to be successful. What works for me won’t necessarily work for you. And, lastly, please don’t be offended if I didn’t like your broker. That’s not the point. It’s about the process in picking a broker that is right for YOU.

Disclaimer: The list of brokers below is 4 years old and some of them are no longer in operation. Good riddance to them too.

****

I hate looking for a new broker. My word, it is exhausting. I remember my first broker experience and I remember reading Trading for a Living by Alexander Elder

. Elder stresses that traders must control costs (one of the few factor we can control) and to change brokers if necessary to do so. Every trader is different so my main criteria for a broker is:

- No slippage and if so, then be courteous enough to ask me if I want to continue on with a requoted price

- No commission

- Not a market maker

- Offers GBP/USD, EUR/GBP AND GBP/AUD. I wanted to start trading the GBP/AUD but my former (and current) broker didn’t (don’t) offer it.

Spreads are not a huge deal for me. If you can deliver on the above, then I don’t mind paying for it (via higher spreads). Because trading with FXCM left me so scarred, I am very wary of the big bank market makers. However, with the new CFTC regulations, I can no longer rule them out as they will probably be the only ones left standing. Also, many smaller brokers are just introducing brokers to the market makers anyway so I may as well deal direct, if I must.

Day 1

My search started with a website that compares brokers. I found a great website in Forex Peace Army (FPA). You always have to take rating and reviews with a grain of salt and try to determine between real traders and the whiners. But it does help to have 2nd opinions as they certainly do help allay doubts and some uncertainties. Through this painstaking search I did find Zecco Forex (through the Google ad, I’ll admit lol). Since Stocktwits partners with Zecco and they met my above criteria, I decided to give their platform a try.

Days 2 & 3

After crawling FPA and checking out different brokers for a day, there had to be a better way. And there is now! I finally turned to Twitter. I have a wonderful crew of traders there so why not ask them? I did and got a slew of recommendations:

- Advanced Markets

- dbfx

- Oanda

- PFGBEST.com

- MB Trading

- Dukascopy

- MIG Bank

- InterbankFX

- Interactive Brokers

- thinkorswim

- Forex.com

- Saxo

- twowayspreads.com

- CitiFXPro

I traded with Forex.com early in my career – don’t like them. In my experience, they have a tendency to permanently widen your spreads once you are trading well. I have an account with InterbankFX already and not too crazy about MT4 (sorry folks). So that left me to judge the remaining brokers based on my criteria. (Most of the links are directly to the page that helped make my decision.)

- Advanced Markets – They have commissions based on initial deposit (which is unfair in my opinion) and trading volume (which as a swing trader I won’t make the cut).

- dbfx – Thanks to the reviews on FPA, it looks like dbfx works through FXCM. I LOOOATHE FXCM.

- Oanda – They meet my criteria though they *may* be a market maker. And I can trade on the iPad?! Beautiful.

- PFGBEST.com – I can’t find any information on their website about fees, spreads, or any other costs involved. That’s a big fail.

- MB Trading – They have commissions. 4 different commissions to be exact. Too much nickel-and-diming for my taste.

- Dukascopy – They have commissions based on initial deposit (which is unfair in my opinion) and trading volume (which as a swing trader I won’t make the cut).

- MIG Bank – They have different leverage, margin requirements AND spreads based on your initial deposit. Too much differentiation for my liking.

- Interactive Brokers – They charge a commission. But it seems fair so I am willing to give them a try. I’m not used to commissions in this market so I am biased against paying them. However, things are changing with the new CFTC regulations so maybe it’s an idea I should get used to. Plus, after researching so many brokers, it seems that commissions may actually be to my benefit.

- thinkorswim – My equity trading friend complained about this platform just last week. Plus, I don’t understand their commission structure – too complicated.

- Saxo – They have a required distance on your stops. Not too crucial for me, as I am not a scalper, but 25 pips minimum stop on my favorite pair is kind of a deal breaker for me.

- twowayspreads.com – I just don’t get it. Are they a broker or a rebate program? Believe it or not, there are forex rebate programs out there. And I’m not going to figure it out with my money.

- CitiFXPro – I researched them a couple years ago. I consider them a market maker. Plus, I wouldn’t bank with Citibank. There is no way I’ll trade with them.

Day 4

Having whittled away at this list, I tried out the platforms of those left standing via a demo account with each broker.

- Interactive Brokers – YIKES! Where are the charts? So confusing as the platform allows one to trade stocks, futures, options. Too many options (no pun intended) for this simple forex girl.

- Oanda – I like the platform. Not thrilled with the chart tools but I think I can work with it.

- Zecco Forex – I love the access to all the different gold charts! Gold/EUR, Gold/GBP!!! That’s about it though. The charting tools here are even worse than Oanda. Plus, they are powered by Forex.com. But the gold charts do keep them in the running.

I plan on trying out these platforms for all of this week but I think I have made a decision.

Conclusion

I like things simple just like in my trading. When it starts to get complicated, whether it was the platform or the fees schedule, I bail. I will miss MGForex. Only time will tell if I made a good choice. If not, I will give Saxo and Advanced Markets another look. I’m not afraid to change brokers even if it is a painful process. As a trader, neither should you.

Originally posted on faithmight.com on September 13, 2010.

Read also:

SNB Rocks The Whole World (FaithMightFX)

Numerous FX Brokers Shutter After Suffering “Significant Losses” Following SNB Stunner (Zero Hedge)

-

SNB Rocks The Whole World

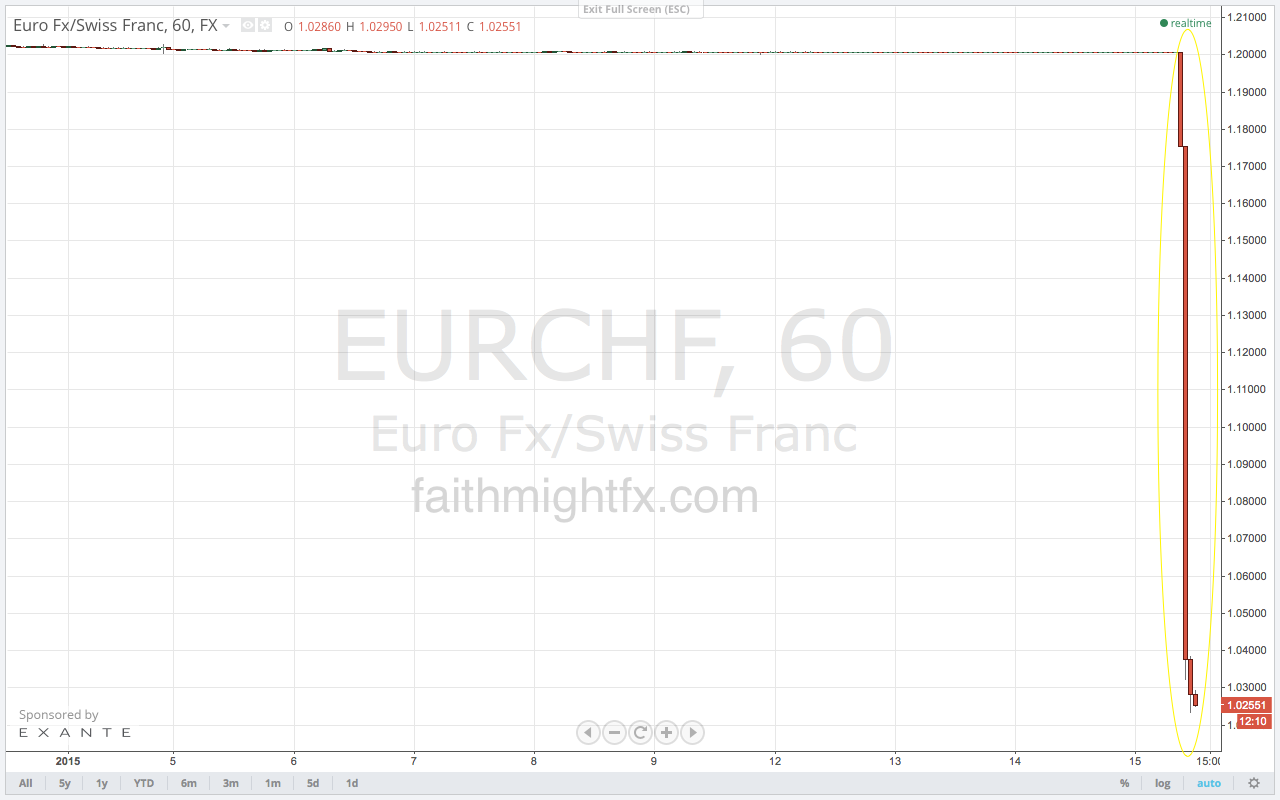

The markets have been ROCKED this morning as the Swiss National Bank (SNB) just announced that they have abandoned the Swiss peg. After 2 years of active intervention in the currency market to hold the $EURCHF at 1.2000, with today’s announcement the SNB has effectively exited the forex markets. This is their 1st monetary policy announcement of 2015 and, while the rate announcement was scheduled, their decision was a major surprise.

The reaction from traders as the decision came down:

Jordan: SNB Exit From Franc Cap Policy Had To Be Surprise >> mission accomplished

— Katie Martin (@katie_martin_FX) January 15, 2015

We’re not even past January, and we can already give the Bullshitter of the Year Award to #SNB Jordan

— ?ukasz Abgarowicz (@abgarman) January 15, 2015

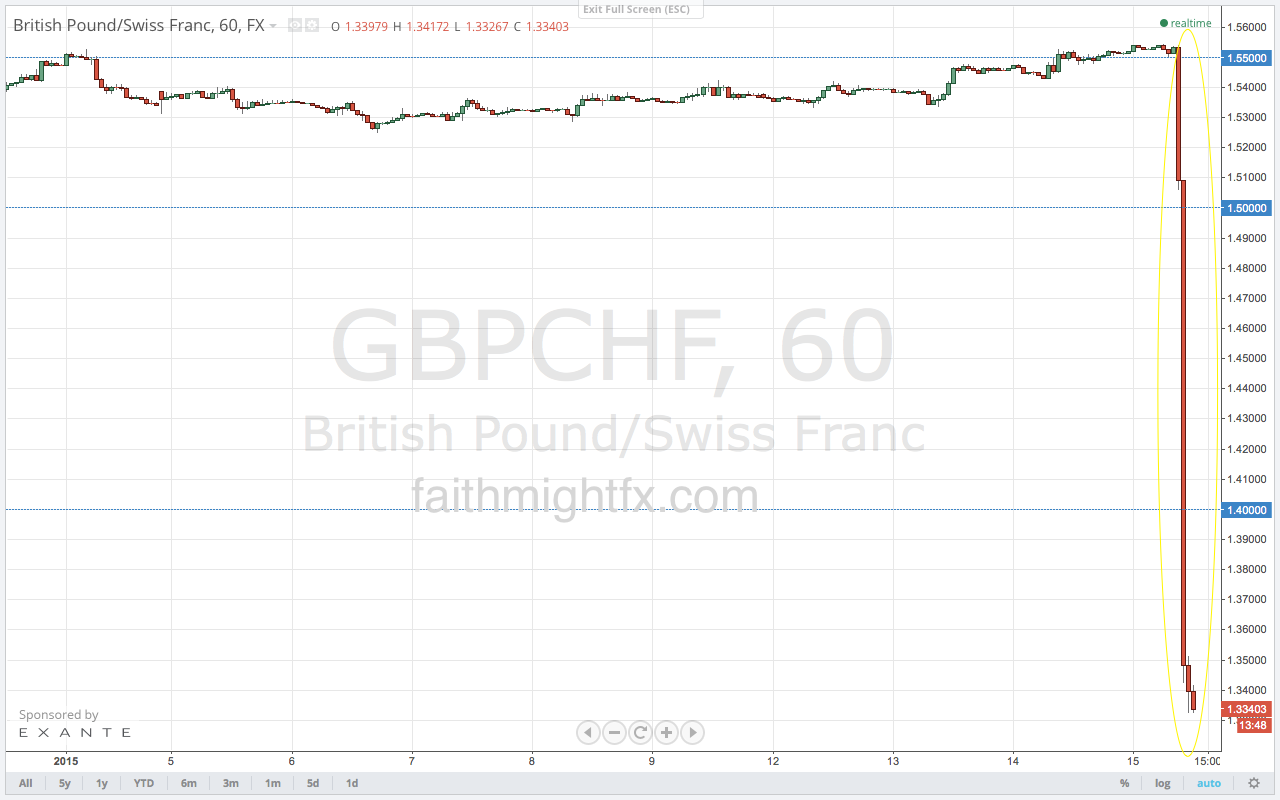

And the effect on the CHF pairs has been EPIC.

The SNB also cut interest rates today to -0.75%. With the abandonment of the currency peg, this interest rate cut was absolutely necessary. The CHF has long been a safe haven currency. Switzerland is considered a financial haven and tax shelter for the ultra-wealthy and has a relatively robust economy. During times of uncertainty, market participants buy Swiss francs. So when the financial crisis hit in 2008, the CHF and USD both strengthened considerably. But a strong currency is a stranglehold on the local economy as it dampens exports demand in the face of muted local consumer demand in 2008. The Federal Reserve enacted quantitative easing in response. The SNB combated the markets with a currency peg. With the peg now gone, the SNB understandably hopes that negative interest rates will dissuade the market from buying francs. However, uncertainty abounds, given the epic moves we are experiencing in the commodities markets, and I doubt even negative interest rates will stem the tide of CHF buyers now coming back into the market.

With the European Central Bank (ECB) due to announce their decision on monetary policy next week, “interesting” doesn’t even begin to describe the forex markets at this point. Everyone has a plan until you get punched in the face. Stay nimble traders.

Read also:

You’ll Never Beat Them. Join Them! (FaithMightFX)

UPDATE: The article was updated to reflect the interest rate cut decision.

-

You’ll Never Beat Them. Join Them!

It is well known that the Swiss National Bank (SNB) has been intervening in the currency market to keep the $EURCHF exchange rate pegged at 1.2000. The SNB is not at all willing to allow their currency to appreciate since the wake of the 2008 financial crisis. The CHF, once considered a safe haven currency, had always rallied in the wake of increased risk aversion in the markets. As such, the strong currency dampened Swiss exports and forced the central bank to keep interest rates low. However, that did not dampen investors flight to the perceived safety of the CHF. Therefore in 2012, the SNB actively stepped into the currency markets to stem the appreciation of its currency.

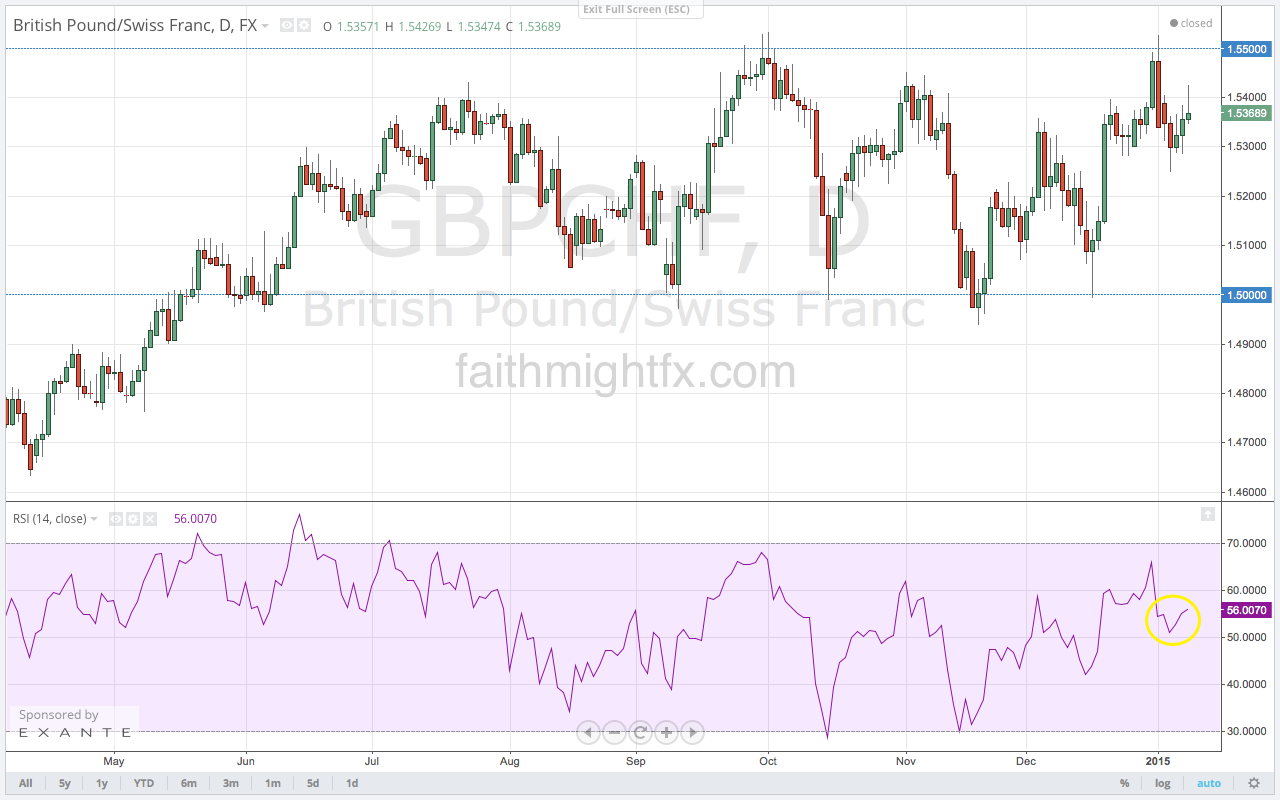

As the financial markets recovered, risk appetite returned sending the CHF lower. During the 2013 rally in sterling, the $GBPCHF enjoyed a move higher to 1.5534. What is interesting, however, is the lack of downside the $GBPCHF has experienced in the wake of recent GBP weakness.

The daily chart has been trapped in a large range between 1.5000 and 1.5500. This has led me to believe that the SNB must also be intervening in the $GBPCHF albeit to a lesser degree than in the $EURCHF. We can see the bullish RSI is an indication of the strong buying interest even after the top of the range was touched and held as resistance. Remaining true it its range, price moved lower but found support mid-range at 1.5250. Without reaching the bottom of the range, the $GBPCHF looks poised to move back to the range top at 1.5500.

-

My Appearance on FXStreet’s Live Analysis Room

I was thrilled to be back in the #FXRoom with Dale Pinkert yesterday. He brought me in to talk all things GBP covering $GBPUSD, $GBPJPY, $GBPAUD, $GBPCAD. But he also gave me some nuggets of wisdom on the EUR via the $EURUSD giving some confirmation on the $EURGBP. The show unexpectedly became a golden example of how traders come together with different perspectives and expertises to edify one another.

I also give a sneak peek to a new service I am launching very soon. Watch out for it!