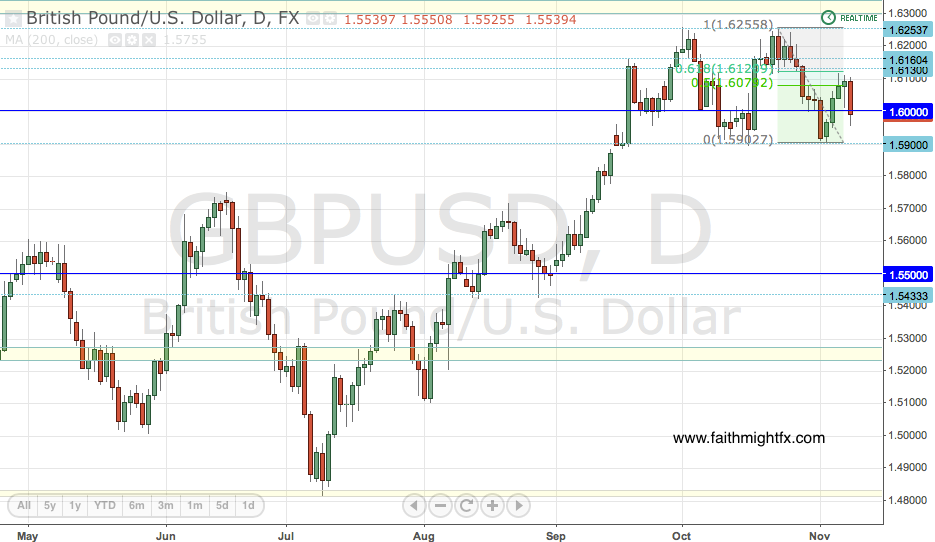

Low inflation has given the BoE the space to keep monetary policy easy as is. That, in turn, supports the economy which is running very robustly. The market has had every reason to be bullish pounds as the UK recovery has proven to take root. $GBPUSD has come off its new highs but still only in a shallow retracement. It’s been a chop fest as cable slides but trades in a range between 1.6750 – 1.6580. This choppy correction is only indicative of the strong bull trend that is in place. I suspect that cable continues lower to find support around 1.65. But I’ve been piping on this for weeks. I guess that means by now all the algos know too.

- Yes. I have been a broken record about this consolidation pattern in $GBPUSD. (FMFX, FMFX, FMFX)

- I couldn’t disagree more with UBS. But retail vs. institutional is nothing new. (eFXnews)

- While I agree with JPM, I’m more bullish than they. (eFXnews)

- Nouriel Roubini is hawkish on the BoE. Is this a contrarian signal to the upside? (Forex Live)

- The fundamentals in the UK are phenomenal. Bad weather be damned. (CNBC)

- I like this long term look at cable. Good stuff. (BruniCharting)