The Federal Reserve did indeed delay to move interest rates again last week. But they did change their monetary policy statement with a sentence of concern for the global economy. Equities reacted to this dovish surprise by selling risk assets. Now investors look to the upcoming third quarter earnings season for coincidental evidence to confirm or refute the world’s concern of Chinese headwinds on capital markets. Therefore, the USD did weaken as expected it would on further delay in increasing interest rates. The $GBPUSD rallied to make a new high at 1.5658. While there were many in the market not expecting the interest rate hike, no one was expecting a more dovish statement and negative interest rates plotted on the dot graph. These developments were both very dovish surprises not anticipated nor discussed. The implications for this sentiment to trend could be either damaging for the USD or very beneficial for the USD. As market expectations for liftoff diminish, the USD should weaken accordingly. Despite strong data 2 weeks ago (Volume 28), U.S. data was extremely weak last week. Soft data is only going to delay the Federal Reserve further. Risk aversion in the markets, however, could strengthen the USD as safe haven flows dominate market flows.

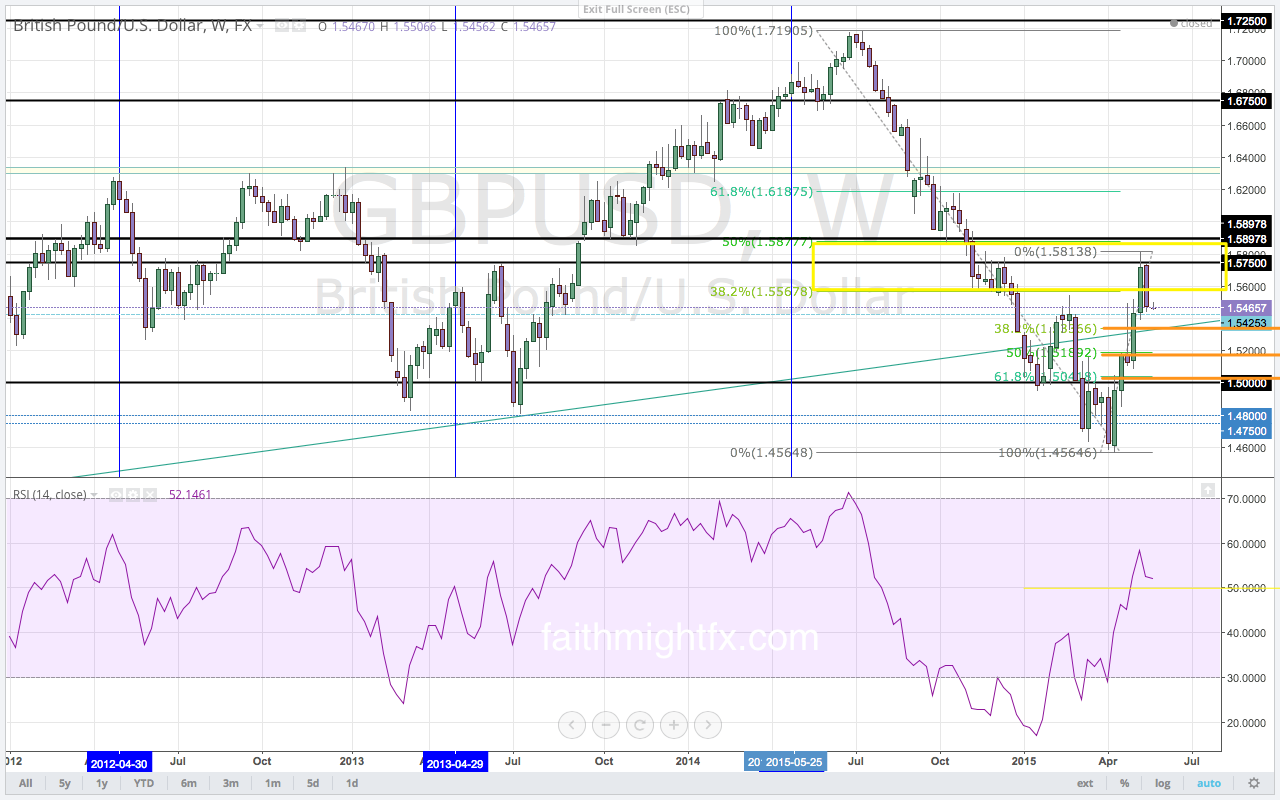

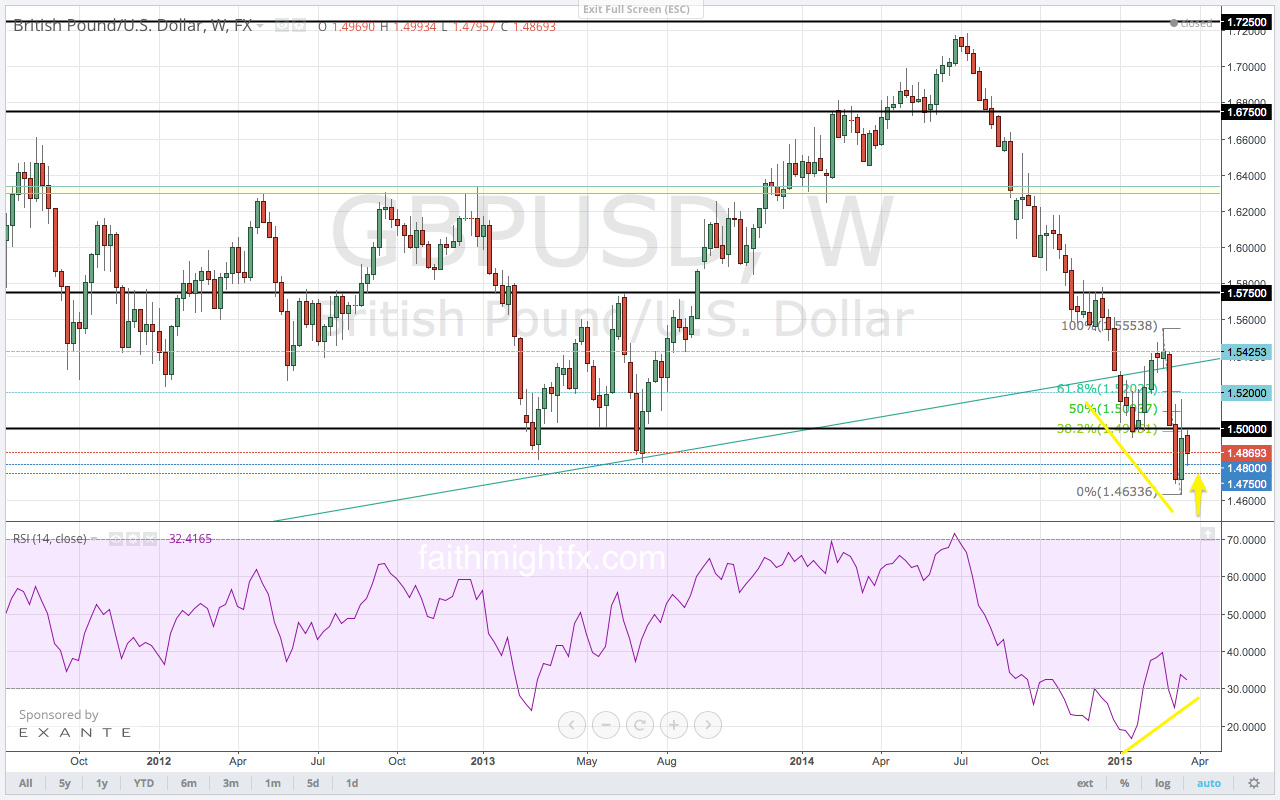

Just last week, the data showed a strong U.S. economy that could force the Federal Reserve to raise interest rates this September. Many market participants believed there was no reason for the Federal Reserve not to raise interest rates last week. Apparently, there is a reason to keep interest rates at 0%. And that reason is China. The highly active accommodation out of the PBoC is revealed to be an actual concern for the Federal Reserve. They are concerned enough to further delayed their initial liftoff plans. Inflation is another, more domestic reason why the Federal Reserve will stay put on interest rates. The central bank sees inflation at 1.6% over the next 2 years. That is well below their target of two percent. As a result, the Fed funds futures show diminishing expectations for an interest rate hike in 2015 altogether. The USD cannot rally as markets start to accelerate the unwinding of expectations for increased U.S. rates. Now that the market perceives that the Federal Reserve will not hike interest rates at all, the GBP/USD may begin to break consolidation to the upside for a trend move back to 1.6000. Those spring calls for 1.6500 become very much in play now based on this new fundamental development.

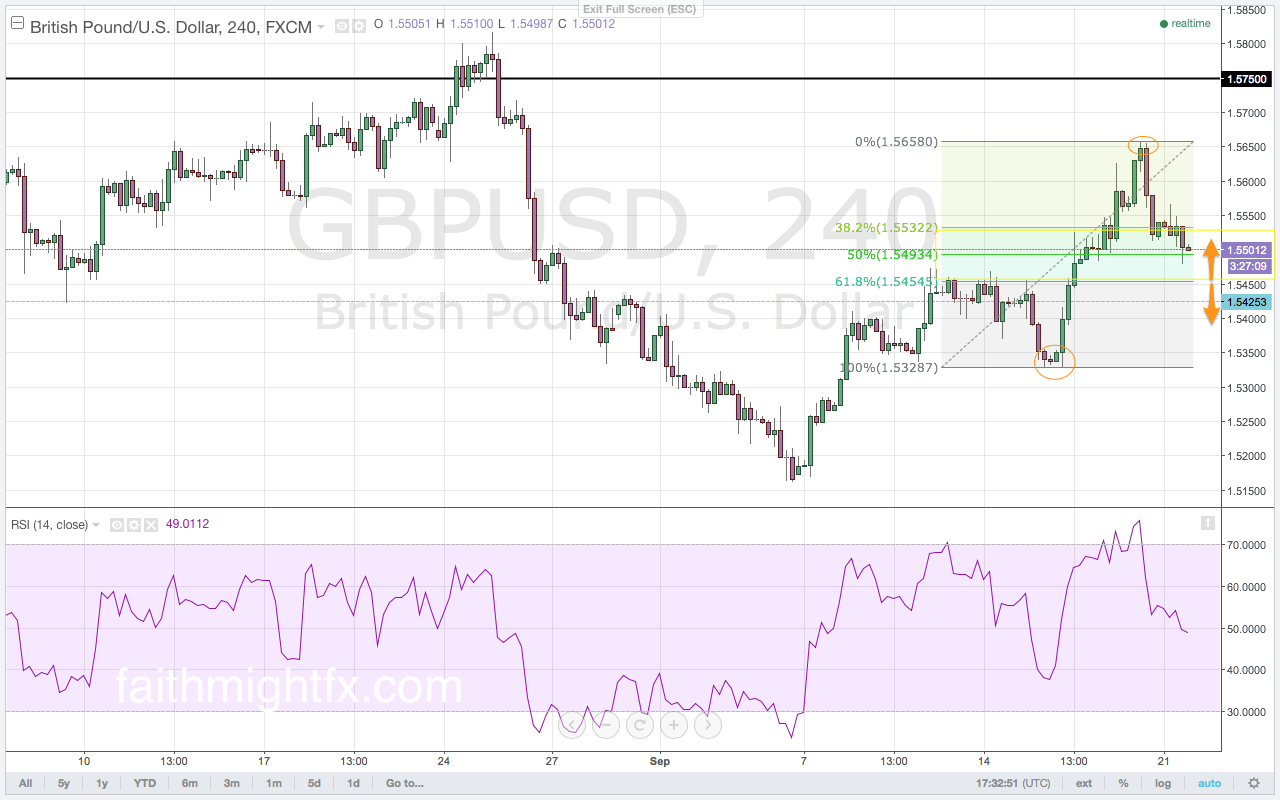

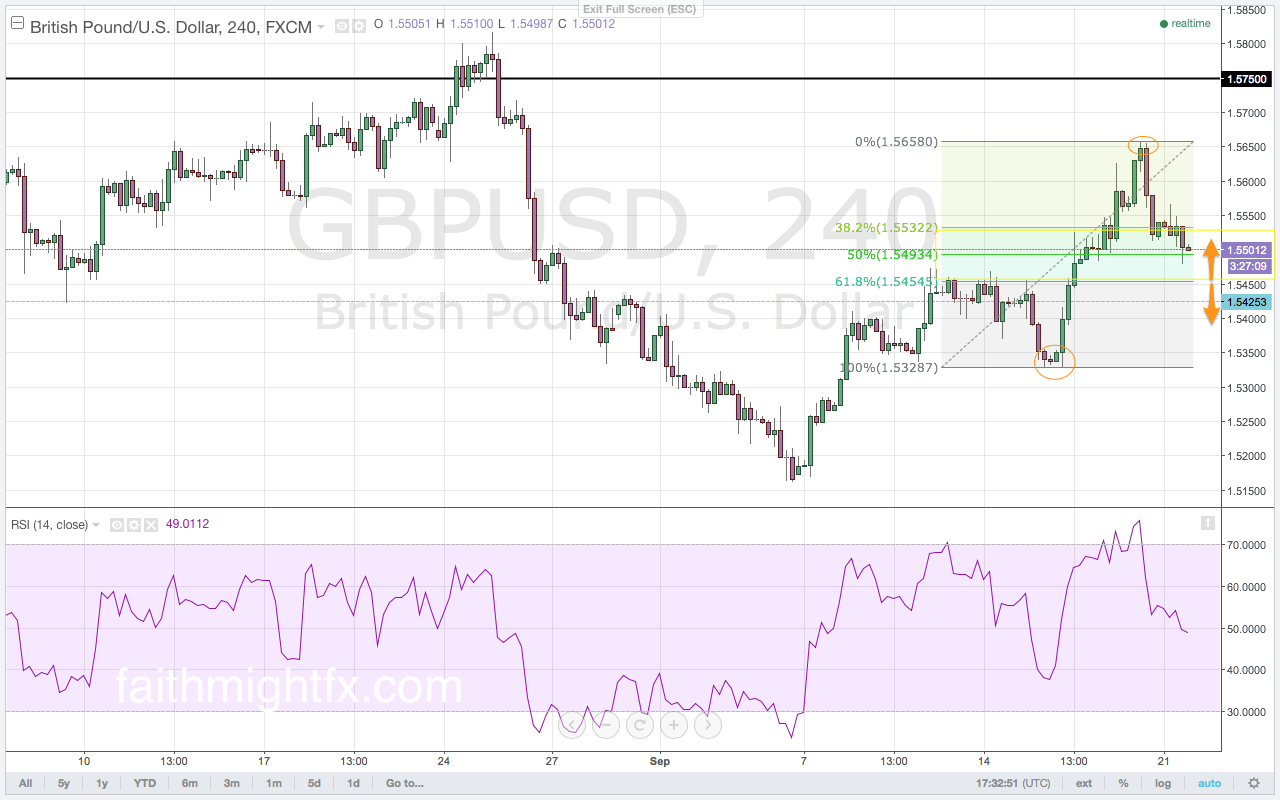

The break to new lows was seemingly a bearish event. The failed high moved exactly where it was supposed to making new lows below the previous 1.5329 low. Price then found staunch support at the 1.5162 level. Supply at this level met bids and rallied higher in trading last week. The $GBPUSD broke well above the sell zone that begins at 1.5413 after the Federal Reserve announcement. Such a move higher moved selling momentum higher into bullish territory. The 1.5500 support level is also a huge psychological level. The USD is likely to weaken further on a more dovish Federal Reserve. If this new sentiment causes extreme volatility in equity markets, however, the USD could actually rally on safe haven flows. Therefore, this buy zone is important to help determine direction for the week. The high last week was just 22 pips from the top of the range. So if the range top holds, the $GBPUSD is actually making a reversal move back to lows. A break or hold of the 1.5450 level is key because it has confluence with the 61.8% Fibonacci level.

This is an excerpt from this week’s issue of QUID REPORT. Subscribers receive my research on all major GBP pairs at the beginning of the week, including access to @faithmightfx on Twitter for daily, real-time updates to the weekly report. AVAILABLE NOW.