Do you have venture capital in your portfolio? A lot of my work is getting investors to understand that venture capital is just another asset class. Because of the rock star status that venture capital-backed companies have and the multi-billion dollar deals that get all the headlines, many folks feel intimidated by the asset class. But it is simply investing. And it doesn’t have to require or involve billions of dollars to participate.

Honestly, if you have the risk tolerance to trade forex, you have the risk tolerance to invest in venture capital. Both asset classes run the risk of losing your entire investment. In fact, forex is probably MORE risky because the leverage required to trade in the forex markets can open up an investor to losing MORE than their principal investment. So you can actually lose more money than you started with when trading in the forex market. That’s not even possible in the private markets. And strangely, no one is scared of that possibility!

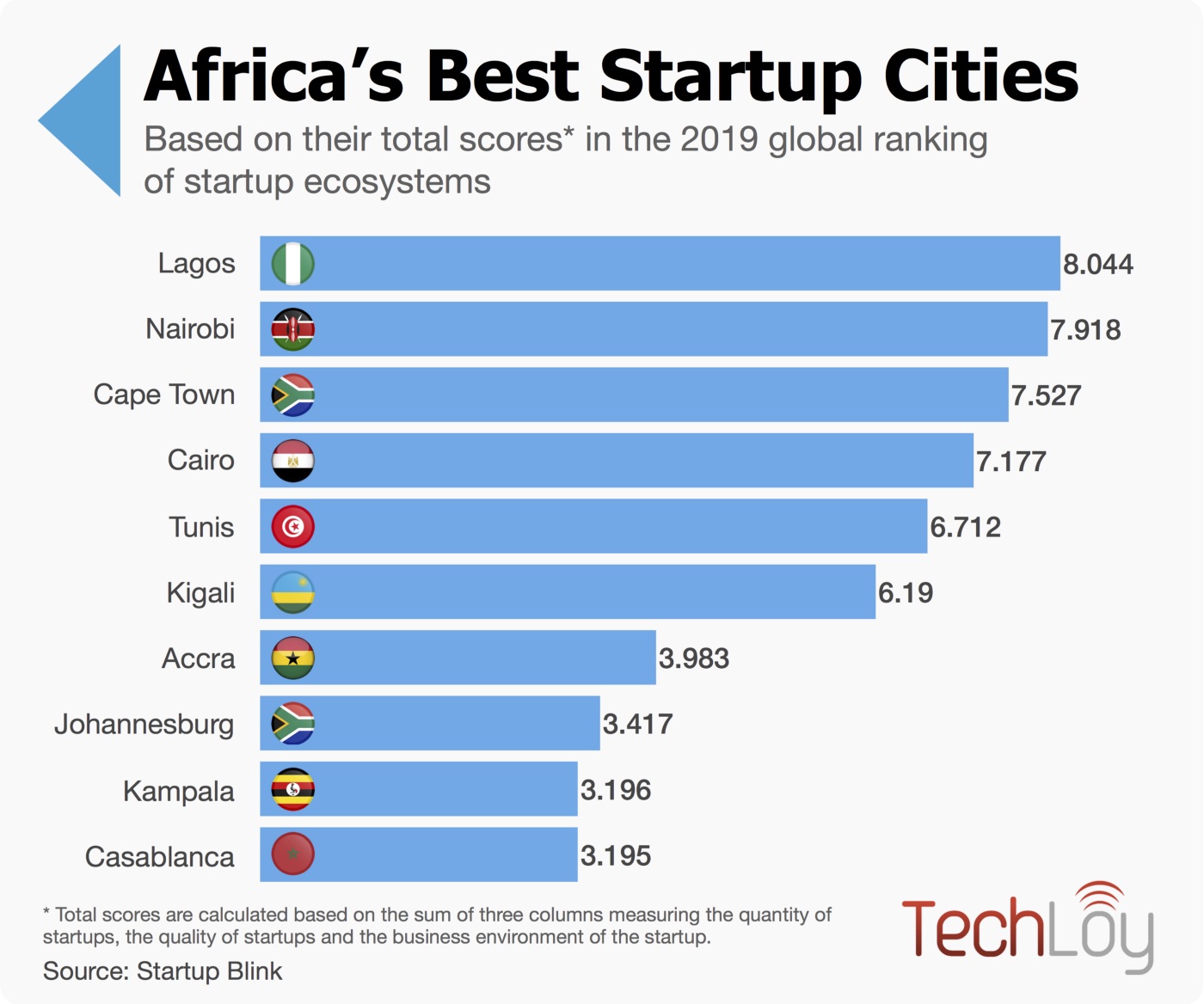

So if you are considering venture capital, the best opportunities lay in Africa and Latin America. There are a number of reasons why, which I won’t get into here. But if you are interested, I compiled a report, “Investing in The Global South”, to outline the opportunity in the region. You can reach out to me for a copy. While I have been investing in Africa for over 8 years, the opportunity is still early. And it is still even earlier in Latin America, which I have been actively sourcing for deals in the past 2 years. Which of the cities do you have in your portfolio?

Leave a Reply