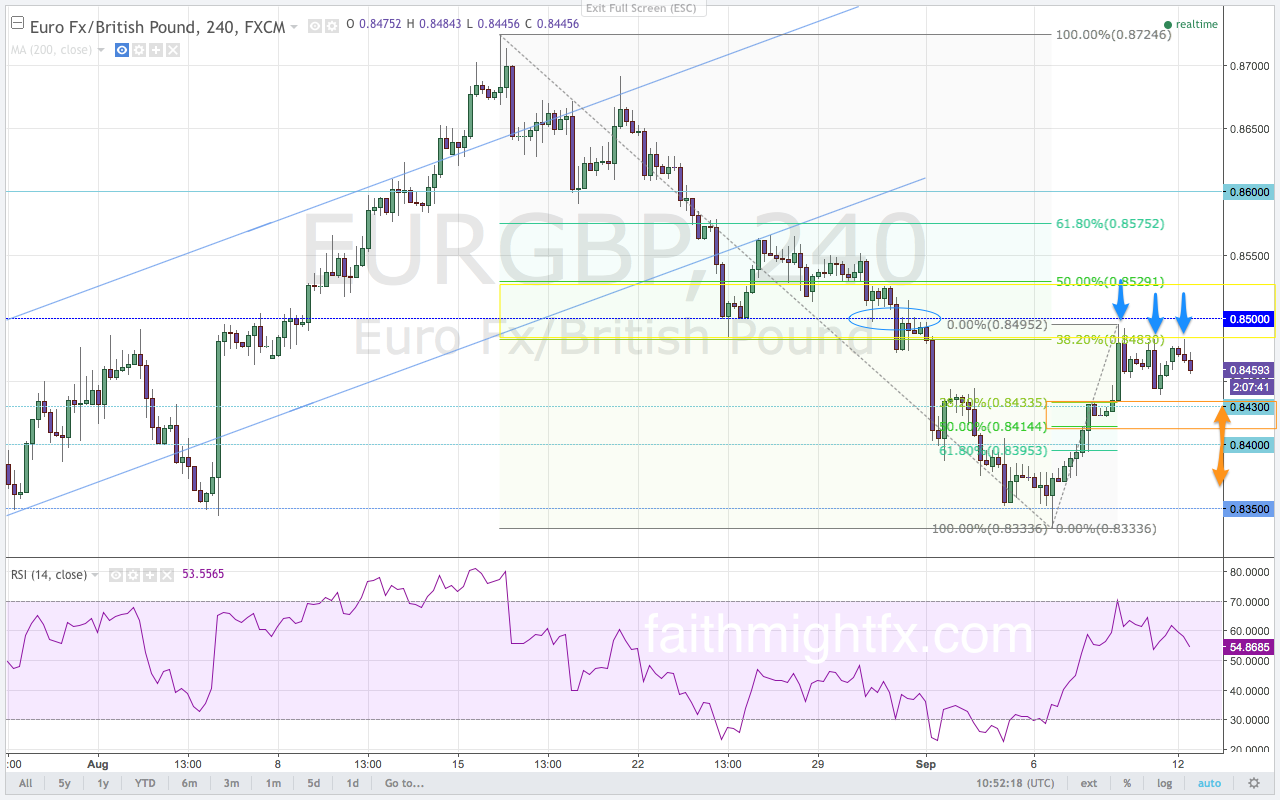

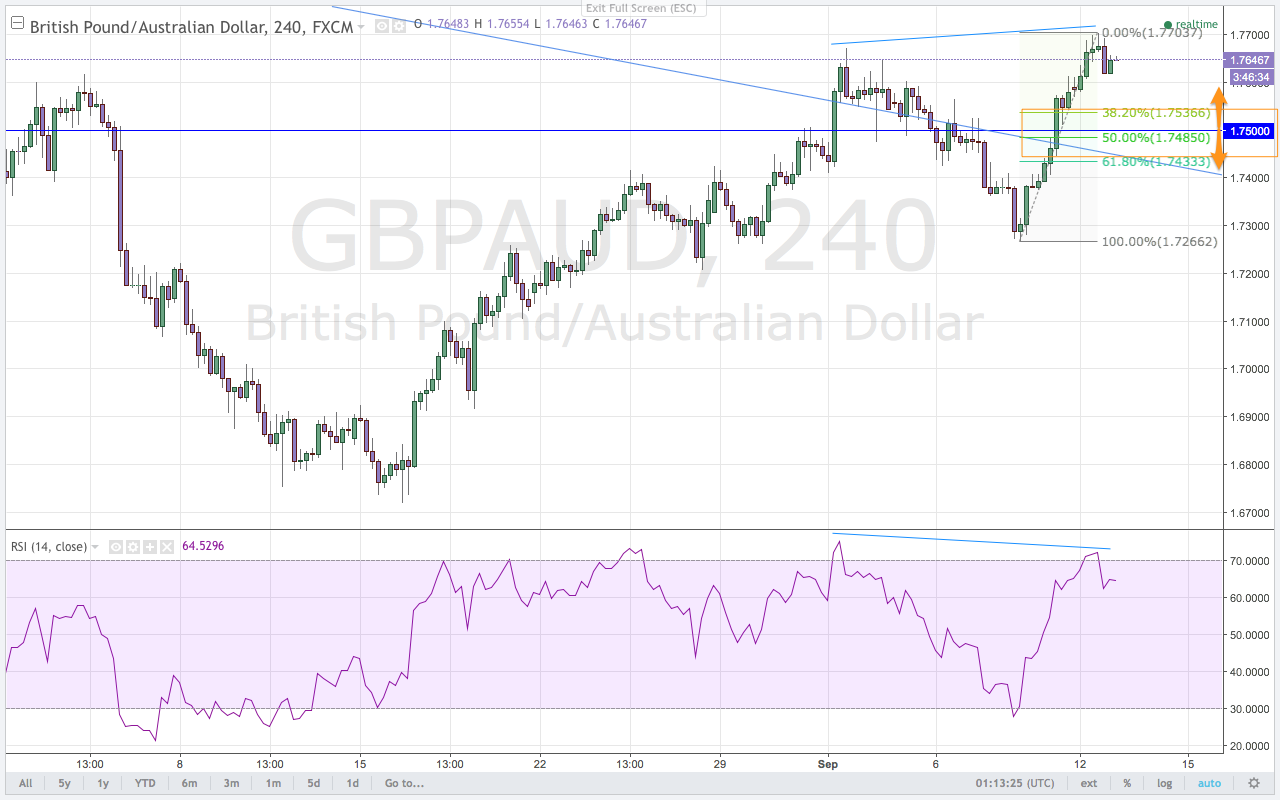

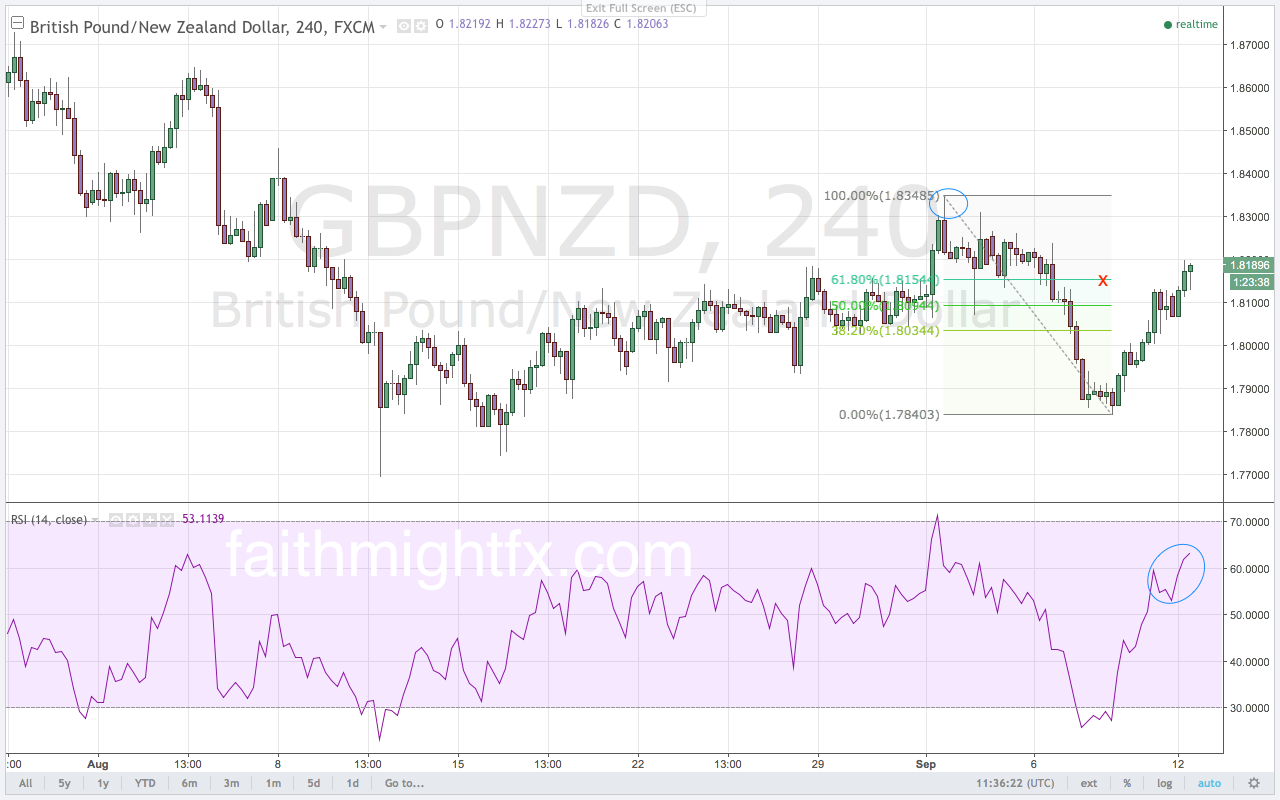

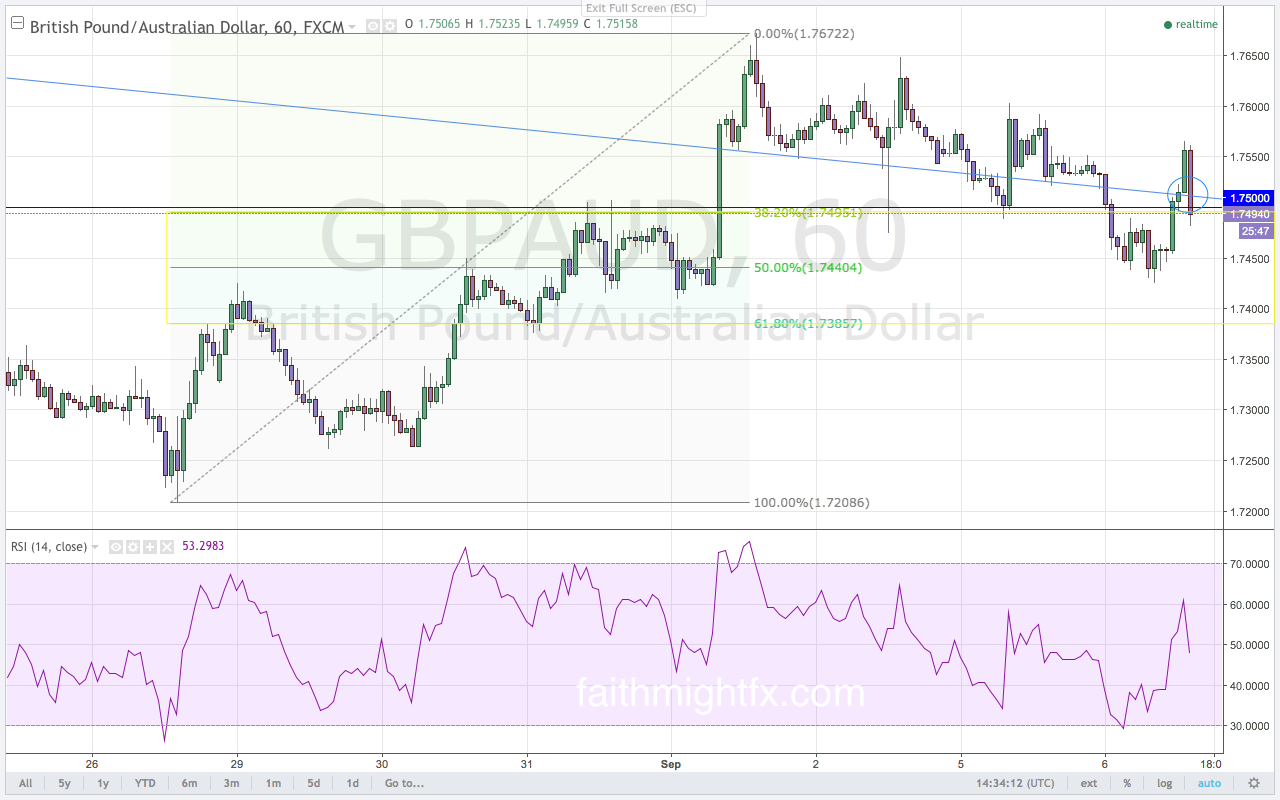

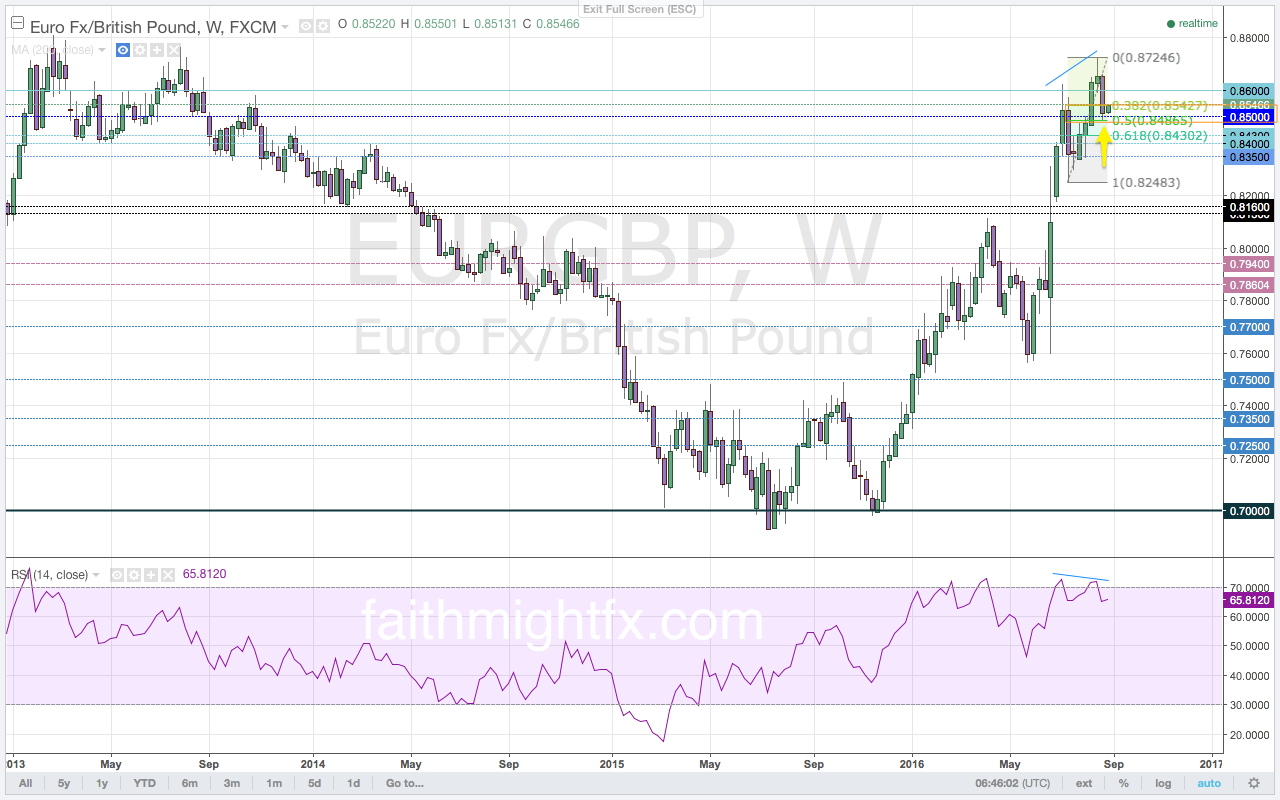

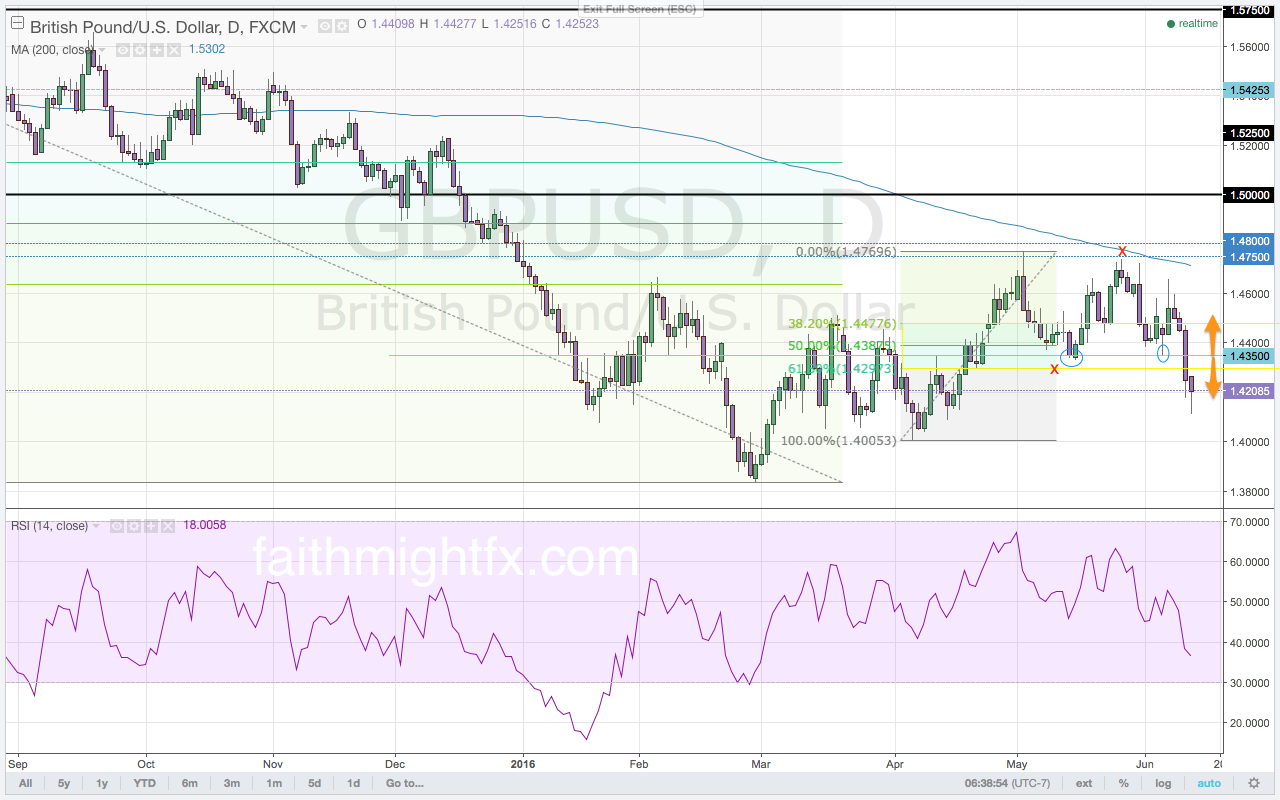

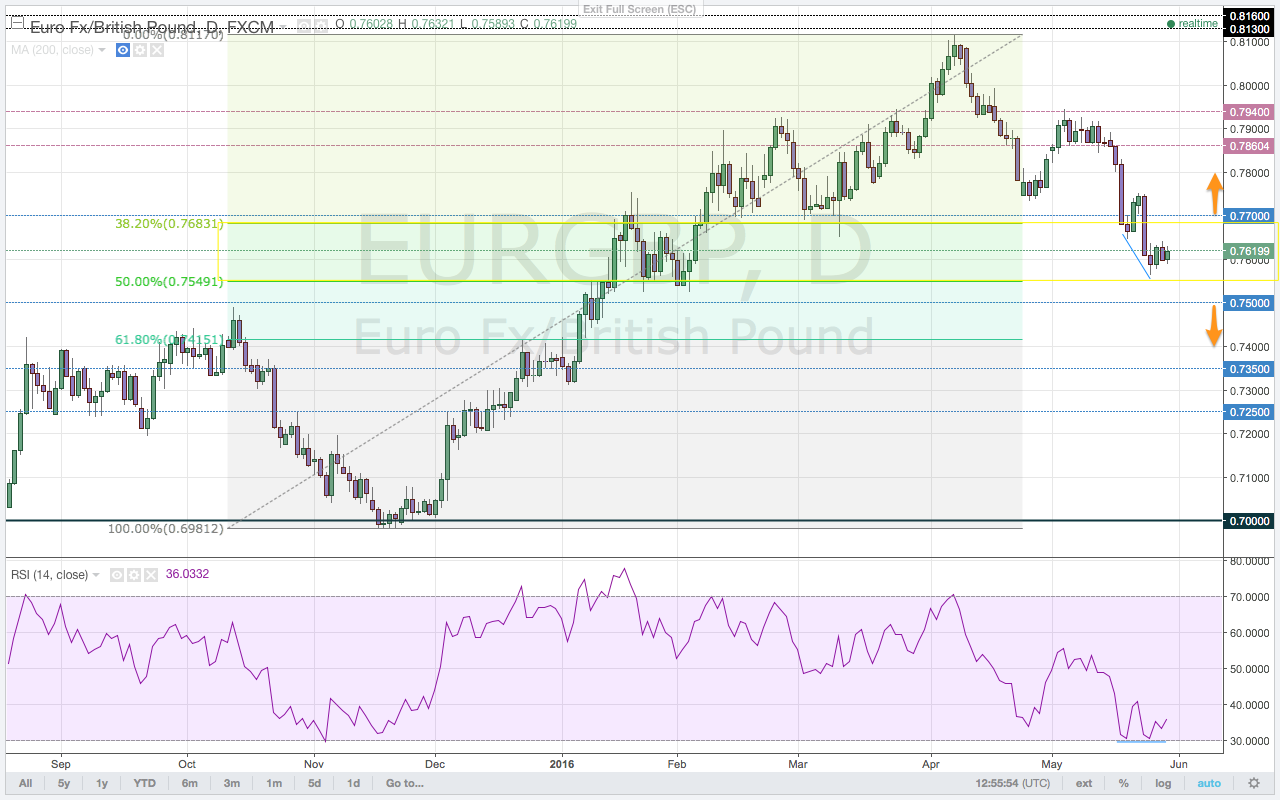

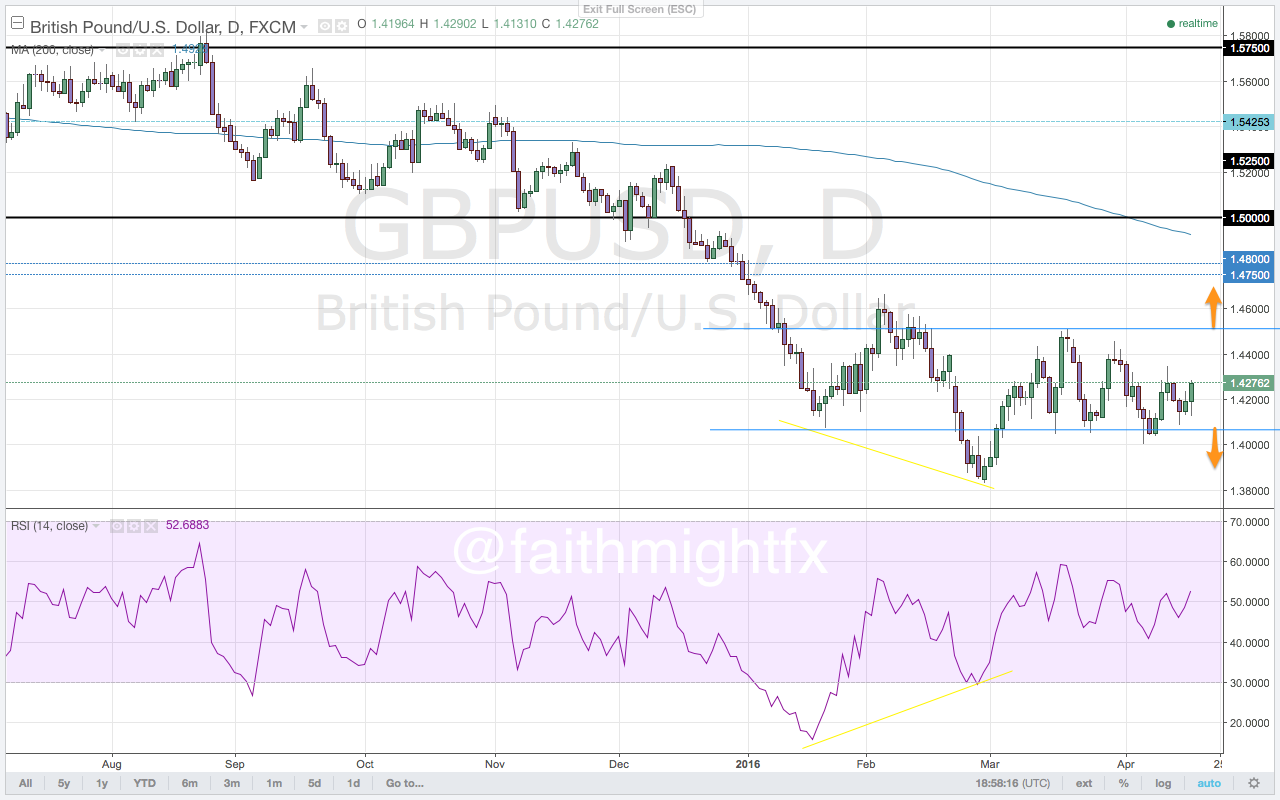

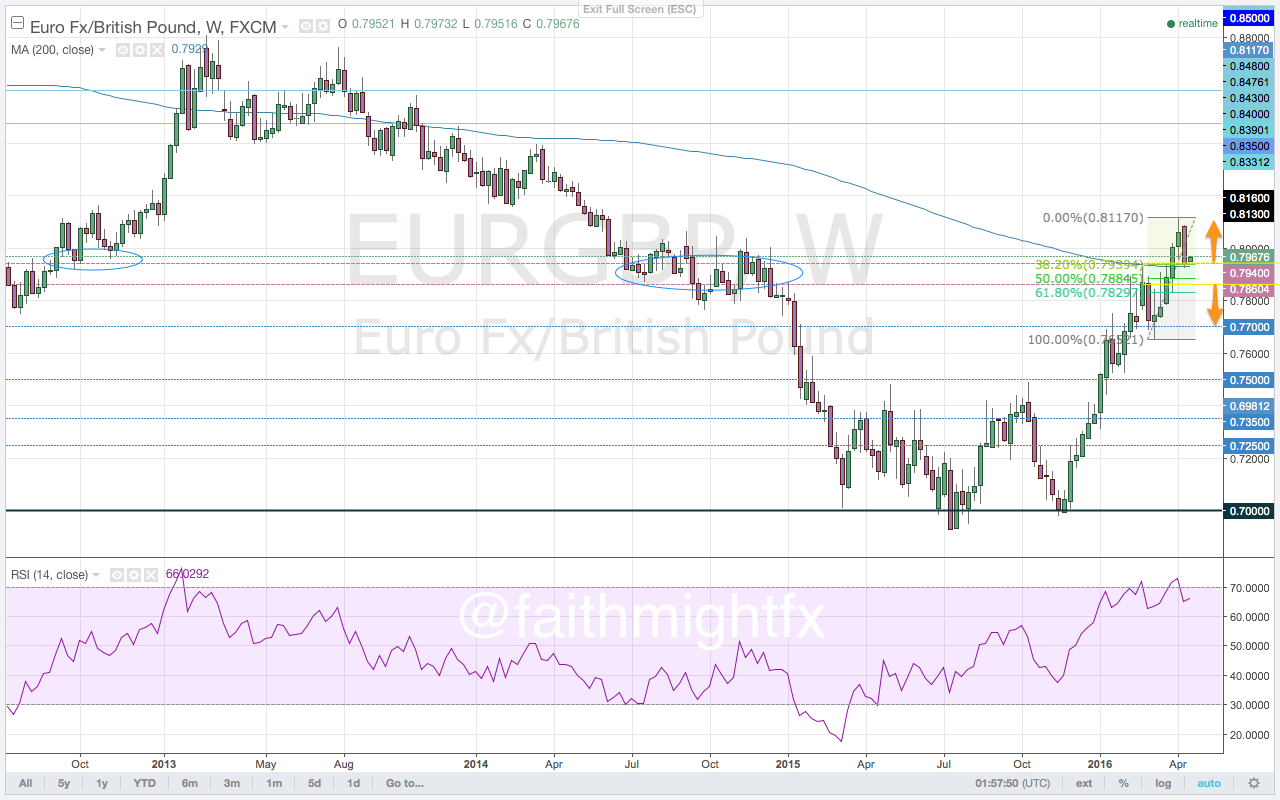

The new trading week is packed with market-moving economic releases out of the UK. Inflation, the UK jobs report and retail sales are all released ahead of the event risk of the week. The event risk of the week for the Great British pound is the BoE interest rate announcement. All of these releases will give a better picture of the British economy in the aftermath of the Brexit shock. It is very likely that these releases are more robust than the market expects. If so, the BoE will not have a reason to move on monetary policy this week causing the Great British pound to rally further. More sterling strength will allow the pound currency pairs to finish consolidation just as the summer doldrums have officially come to an end.

How shall we trade the GBP this week?

Well, we came into the week with a ton of GBP strength.

With CPI and regular wages both weaker than expected, inflation is not raging at all in the British economy.

The lack of inflation in wages, though still relatively high, will keep the BoE away from any tightening measures. Coupled with weak consumer prices, the BoE may signal a further loosening monetary policy this week. As such, the GBP strength that started the week is starting to fizzle as we get closer to the actual Bank of England announcement this week. The Friday close will be significant for direction sterling into the end of the year. The summer is officially over. Volatility and traders are back and with them a clear trend is likely to emerge.