There is always a bull market somewhere.

Jim Cramer

When oil markets turned negative in April, gold was making new highs at the time. When stocks crashed 2 months ago, bonds made all time highs. Investors have to start seeing price crashes as a signal of opportunity…opportunity in other markets.

When 30-year U.S. Treasury bonds (expressed in $TLT) made new all-time highs, the Fed had slashed interest rates 150 bps in 3 weeks and put the market on notice with brand new lending facilities and unprecedented QE. Since then, markets have been digesting this newly deployed medicine to the financial tremors of a public health crisis. This digestion hasn’t been pretty for U.S. Treasuries. $TLT corrected lower and then settled into a trading range in the month of May. While price is still in a correction, there are some technical and fundamental alignments that make a bear case for bonds.

1. The failed high on the corrective bounce with new lows.

A deep correction immediately followed the blowoff rally in April. That correction moved price right into the 61.8% Fibonacci level. So this rally back above the 160.00 level is fairly impressive. It’s been fueled by QE and interest rate cuts along with a commitment to indefinite monetary policy of the most extreme measures from Federal Reserve Chairman Powell just last week. However, all of that has not moved price to new highs. In fact, the failed high signals price moves below that correction low at 139.01. That’s over 20 points lower than today’s 163.59 closing price.

2. The bearish divergence in RSI

The RSI on the weekly chart is showing a divergence with price at the notable all-time high. Subsequent momentum since then has been diminishing and, today, has broken lower to with a close at new lows since the beginning of March. Even as price recovered in March and April, the RSI continued to put in lower highs along with the lower highs in price which is confirming price action. First the divergence bearish signal. Then the weakening strength to confirm that more sellers are entering the market (or perhaps that more buyers are exiting).

3. The geopolitical risk is quietly escalating between the U.S. and China

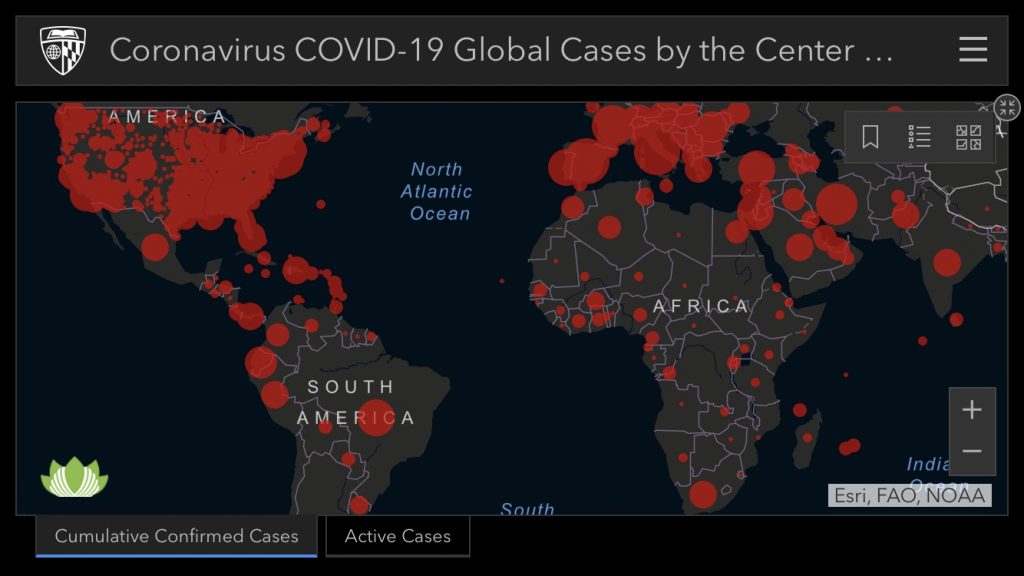

What would be a real reason for bonds to sell off though? Well what about when the largest holder of long-term bonds decides they rather hold another asset instead? While the war of words may have ceased at the end of last year, China has allowed its currency, which it held in tight control, to devalue this year. In the second half of 2019, the $USDCHY first moved above the coveted 7.00 resistance level for the first time since 2008. When it seemed like the U.S. and China had come to some agreement, the $USDCHY dropped back below 7.00. Since tensions have warmed back up as COVID-19 ravished the United States, the $USDCNY has moved back above the 7.00 resistance level with fresh bullish momentum. It is expected that the Chinese government would be quite comfortable with allowing market forces to take its currency even lower.

All that and the situation in Hong Kong makes things even more worrisome. With mainland China changing the laws last minute this week, watch how markets react to Hong Kong, basically, get taken back over by China. This is a huge deal for financial markets and a big signal from China that don’t feel the need to participate in free markets for its long-term growth plans. So does it really need all those U.S. Treasury bonds now too? Interesting times…

[UPDATE] 4. The Fed

My fellow lady trader, @NicTrades, summed it up best.

Read more:

If you are interested in learning how I found these levels, please check out the CHARTS101 course. Read the charts for yourself so you can trade what you see and not what I think.