Nvidia Corporation is one of the largest developers of graphics processors and chipsets for personal computers and game consoles. The head office is in Santa Clara, California. NVIDIA Corporation does not have its own manufacturing facilities and therefore works according to the fabless principle.

The company was founded in January 1993 by Jen-Hsun Huang, Curtis Priem and Chris Malachowsky. In May 1995, Nvidia launched the NV1 (STG-2000), one of the first 3D accelerator processors (GPU). In January 1999, Nvidia was included in the NASDAQ (NVDA) and delivered the ten millionth graphics chip in the same year. In the Forbes Global 2000 of the world’s largest companies, Nvidia ranks 572 (as of: 2017 financial year). The company had a market value of approximately US $155 billion in mid-2018.

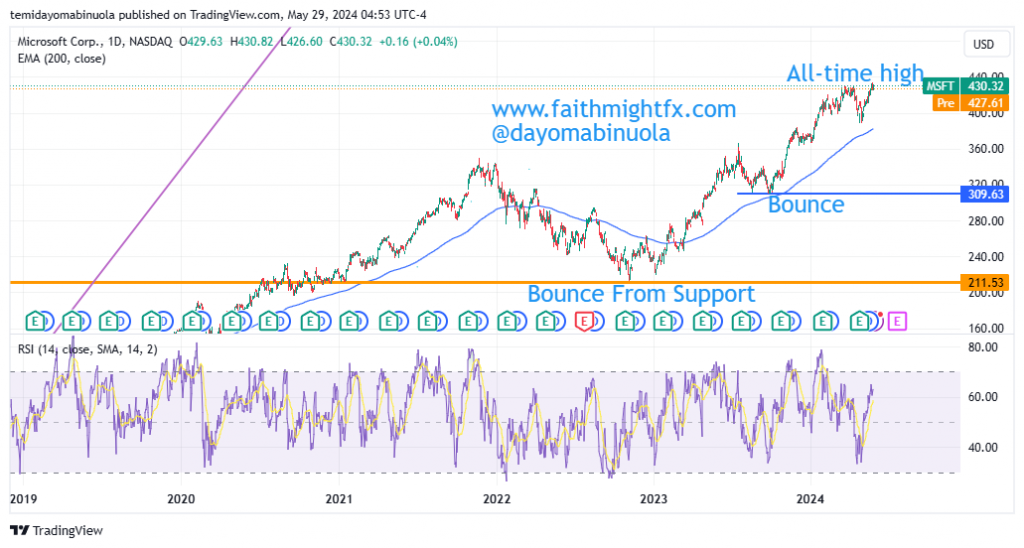

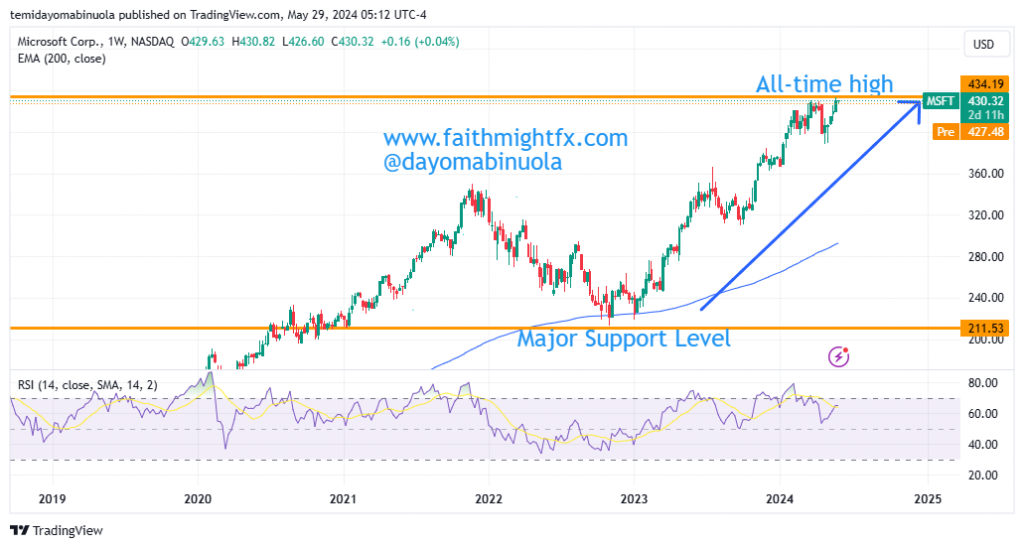

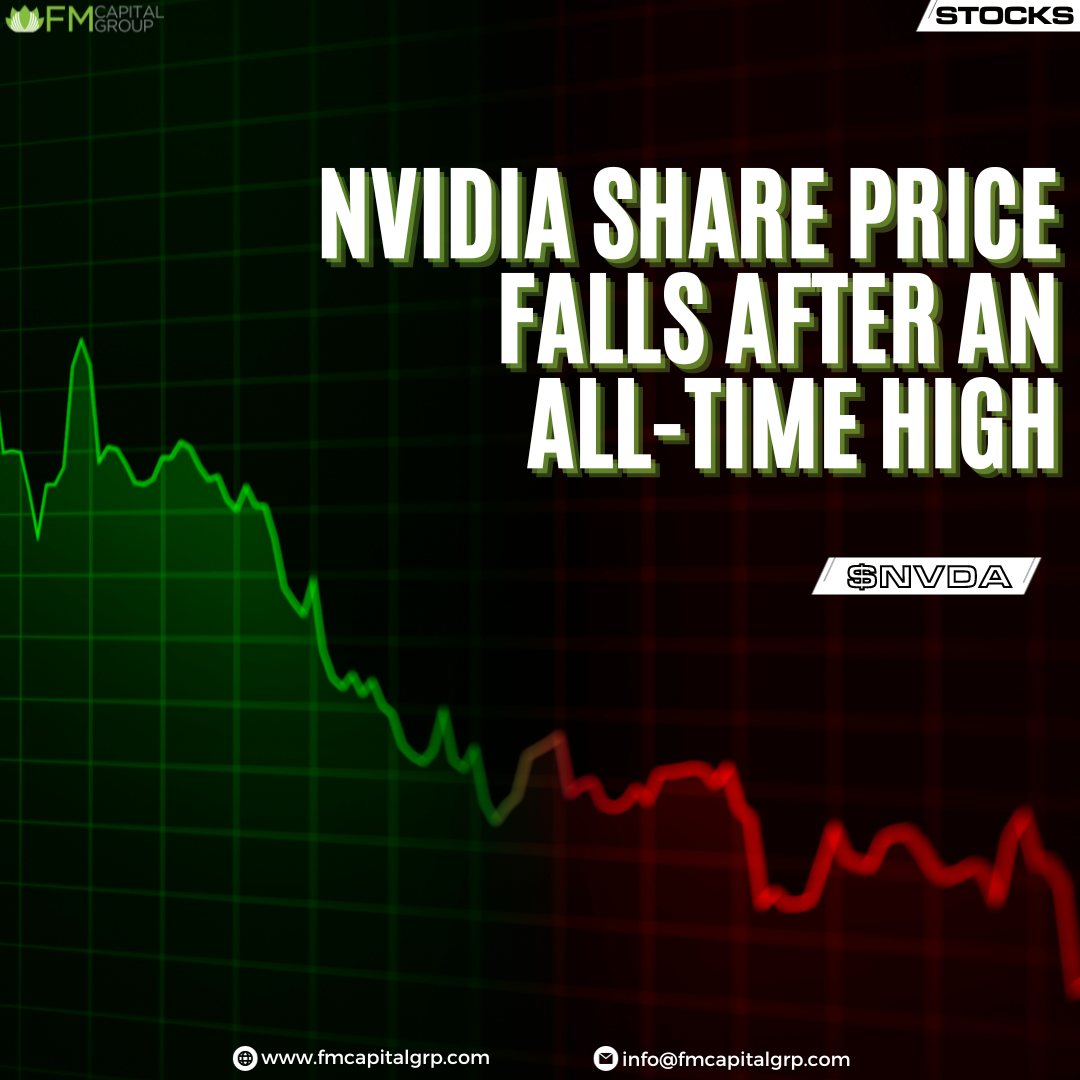

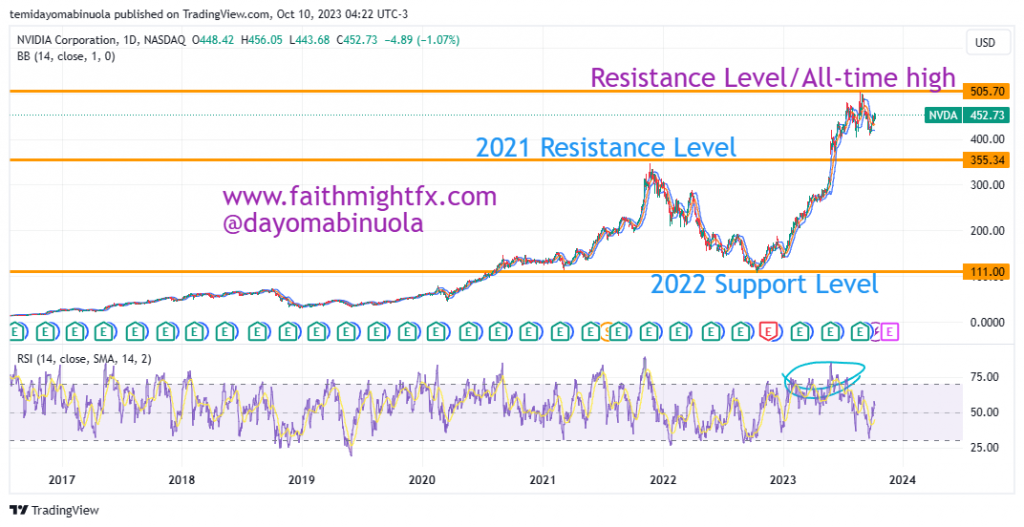

Fast-forward to May 2024, $NVDA is the third most valuable company in the world with a market capitalisation of $2.829 Trillion. On March 8, 2024, Nvidia reached a high of $977 before price fell to $755 in April 2024. A rally began in the latter part of April which has resulted into Nvidia reaching new highs in May 2024.

In the month of May, Nvidia had at least 5 Gap ups on the daily chart. $NVDA is currently at $1134. There might be a price reversal to these gap ups in the coming weeks. This reversal might eventually drop the price of Nvidia to $784. Eventually if Nvidia price fall to the $784 price level, Nvidia might no longer be the third most valuable company in the world. RSI on the weekly and daily shows price has been overbought.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here