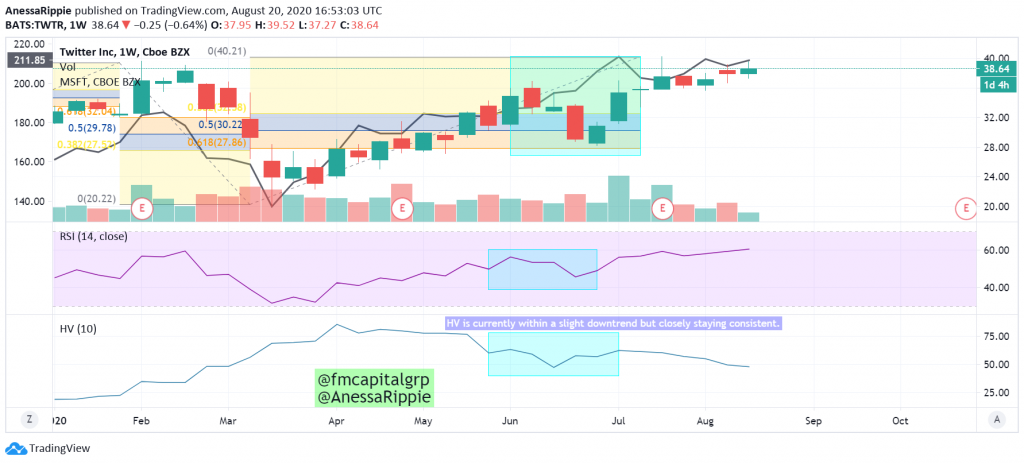

The global lockdown made price of Crude Oil fall to the negative region. The price of Crude Oil began to increase when a gradual ease of the lockdown began last year. The highest level crude oil price reached in 2021 was at 67.83. Before 2021, this level was reached in October 2018, which was a year before the coronavirus was declared a pandemic. Prior to the pandemic, the price of crude oil ranged between $42.73 and $66.76, until a dip occurred as a result of the lockdown. The current price of crude is at 61.00 as price has been ranging from 57.28 and 67.83 in the last few weeks. Few countries like Italy is back to lockdown due to spike in Covid-19 cases. Also, some cities in India are not left out. Hopes are currently being dashed due to increase in Covid-19 cases, despite vaccines are being administered across the world.

There are 4 instances of RSI showing price being overbought in the last two years. This year has been bullish with the $CL price, which opened at 47.15 to reach the highest level at $67.83. Towards the end of last month, price has been able to move to the lower region of the the Bollinger bands, which might be an indication of a reversal. If Covid-19 cases continue to rise across the world, the price of $CL might be lowered towards the support level at $35.85.