Carnival corporation &plc is a British-American cruise operator with a combined fleet of over 100 vessels across 10 cruise line brands. Carnival corporation had its IPO in July 1987 at $3.94 per share. Carnival corporation is listed on NYSE and LSE. As of this year, the total staff of Carnival corporation stands at 150,000.

Carnival corporation & plc announces offering of $1.25 Billion for refinancing to be issued by Carnival Holdings in Bermuda. This news could have been the reason for an uprise in the price of Carnival yesterday, with 11.14% appreciation in price.

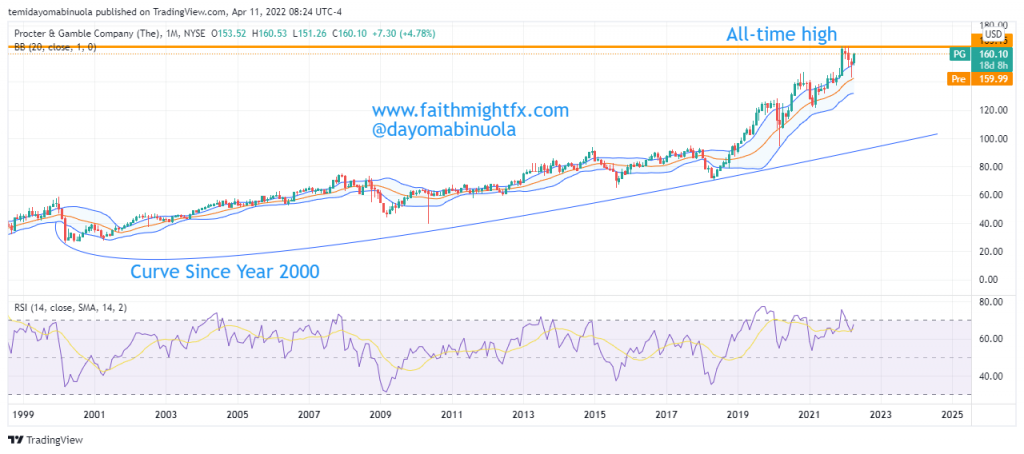

Over the years as price rallied, $CCL reach an all-time high in January 2018 at $72.85 and fell to $8.08 as a result of the 2020 pandemic. Post-Lockdown, a rally to $31.83 occurred in 2021, which currently stands as a a two-year high. Before the 11.14% rally yesterday, the price of $CCL fell to $5.89, which makes it the lowest price since 1991. We might be seeing a rally to $11 in the coming weeks from its current price at $8.08.

Some of these ideas are in our clients’ portfolios. To understand if this one can work for you or for help to invest your own wealth, talk to our advisors at FM Capital Group. Would you like more information on how to get stocks in your portfolio? Schedule a meeting with us here